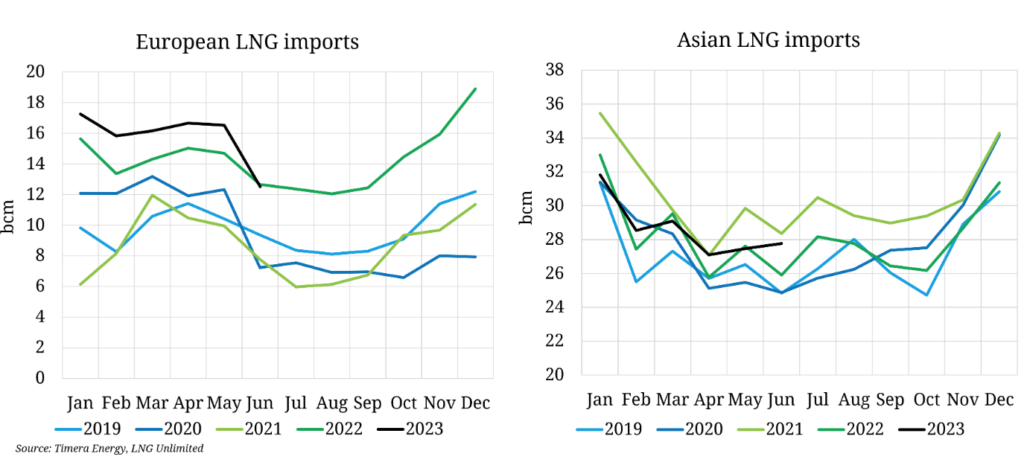

Weak demand in Europe, in part due to below average storage injection requirements, and the corresponding softening of global gas prices, has driven an uptick in Asian LNG demand, with imports to the region sitting ~2 bcm higher y/y in June (vs an average of just 0.1 bcm higher y/y over the first five months of 2023).

This uptrend has been driven primarily by China, where imports were at their highest since January at over 8 bcm in June (+ 2.2 bcm y/y). Lower spot prices thus look to be incentivising some Chinese buyers to return to the spot market, although overall APAC imports remain below 2021 levels, in part due to lower JKT demand on increased nuclear power generation.

Returning Asian demand, alongside seasonal LNG maintenance activities, has seen European LNG imports drop sharply from record Q2 levels. Imports sat at ~12.5 bcm in June, over 4 bcm lower month on month, and the first year on year reduction since September 2021. In conjunction with lower NCS supply, this contraction in LNG imports drove a temporary rebound in TTF prices, highlighting the support returning Asian demand can offer to global gas prices. However, TTF prices have since returned close to YTD lows, reflecting the fragility of this anchor, and the need for further growth in Chinese and broader Pacific basin buying activity to stymie price losses this summer.

Source: Timera Energy