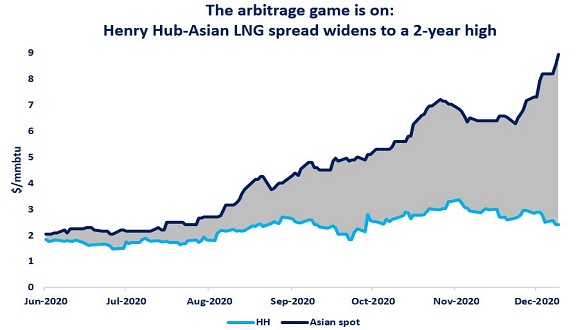

Who wants to play arbitrage? The spread between Henry Hub and Asian spot LNG widened to a 2-year high and is now nearing a hefty $7/mmbtu, up from zero back in June.

The spread almost double since the beginning of November, driven by bearish factors in US and bulls riding in Asia.

In the US milder the expected weather, a looming storage overhang (up by 10% yoy) put further downward pressure on Henry Hub, loosing almost 30% of its value since the start of the US heating season.

In contrast, in Asia winter bulls have pushed JKM to $9/mmbtu, amidst colder weather in northeast China, coal caps in Korea, and a number of outages at LNG liquefaction plants (Qatargas T4, Gorgon worries, Snøhvit fire, etc), further tightening the overall supply-demand picture for LNG.

Meanwhile, US LNG is displaying strong upward flexibility, with feedgas flows reaching new records, trending at above 300 mmcm/d with Corpus Christi T3 starting commercial operations as well.

And the spread between JKM and TTF climbed to $3.5/mmbtu, its highest since summer 2018, meaning that the steep fall in LNG deliveries to Europe is set to continue.

What is your view? How will inter-regional price spreads evolve through the winter season? Any downside risks for Asian spot prices?

Source: Greg Molnar

See original post by Greg on LinkedIn.