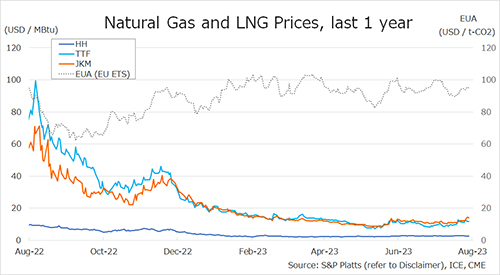

The Northeast Asian assessed spot LNG price JKM for the previous week (14-18 August) rose to USD 14/MBtu at mid-week from USD 12/MBtu the previous week due to uncertainty over supply concerns related to strikes at major LNG projects in Australia.

METI announced on 16 August that Japan’s LNG inventories for power generation totaled 1.98 million tonnes as of 13 August, up 0.12 million tonnes from the previous week, down 0.77 million tonnes from the end of the same month of last year and down 0.02 million tonnes from the average of the past five years.

The European gas price TTF briefly exceeded USD 12/MBtu on 15 August from USD 11.4/MBtu the previous week and then turned downward and hovered in the middle of USD 11s.

ACER published the 18 August spot LNG assessment price for delivery to the EU at EUR 36.8/MWh (equivalent to USD 11.7/MBtu).

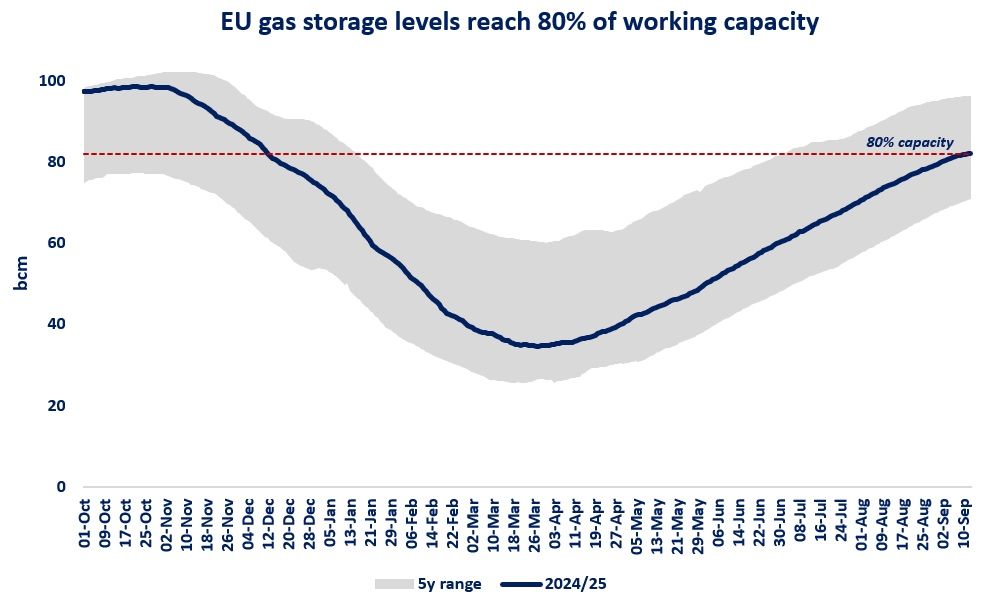

According to AGSI+, the European underground gas storage rate as of 16 August was 90.1%, exceeding a binding EU target of 90% by 1 November ahead of winter.

The U.S. gas price HH turned down from the previous week’s USD 2.8/MBtu and slightly fell to the USD 2.5/MBtu level toward the end of the week.

According to the EIA Weekly Natural Gas Storage Report released on 17 August, the U.S. natural gas underground storage on 11 August was 3,065 Bcf, up 35 Bcf from the previous week, up 21.8% from the same period last year, and up 10.8% from the average of the past five years.

Source: JOGMEC