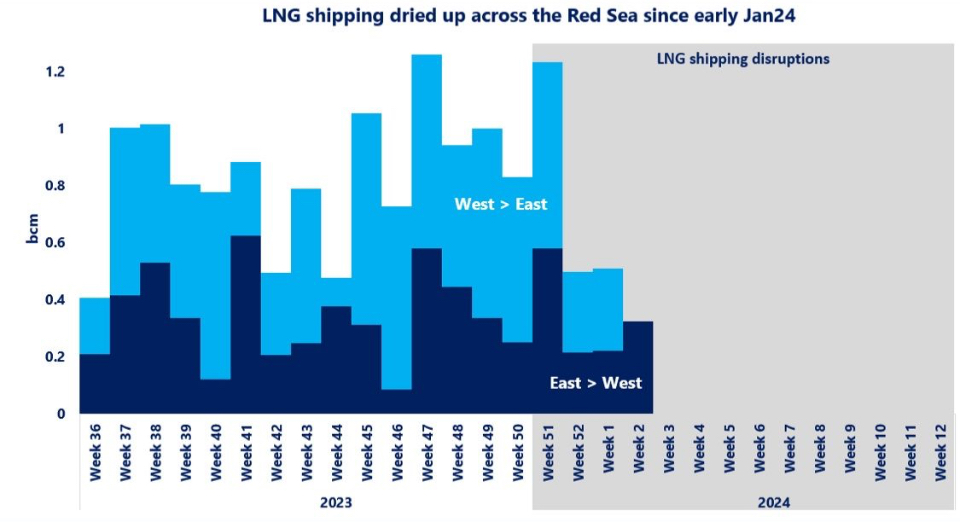

LNG flows dried up via the Suez Canal since early January 2024, with no LNG carrier passing the Red Sea in the last 70 days due to security concerns.

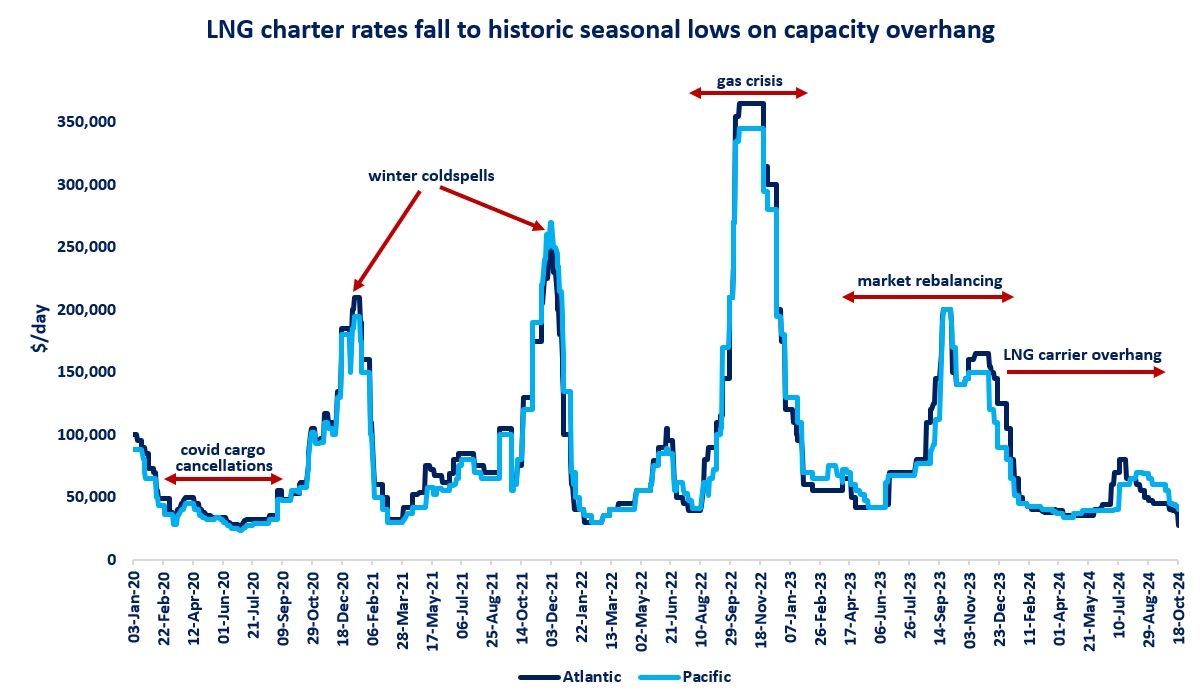

While the Red Sea crisis leads to more lengthy and sub-optimal shipping routes, the impact on gas prices and charter rates was rather limited so far, as they continued their downward trend in Q1 2024.

There are a couple of reasons why the Red Sea crisis had limited implications on LNG shipping fundamentals:

(1) no impact on LNG production: Qatar kept its gas production close to last year’s levels, while increasingly rerouting flows towards its Asian markets;

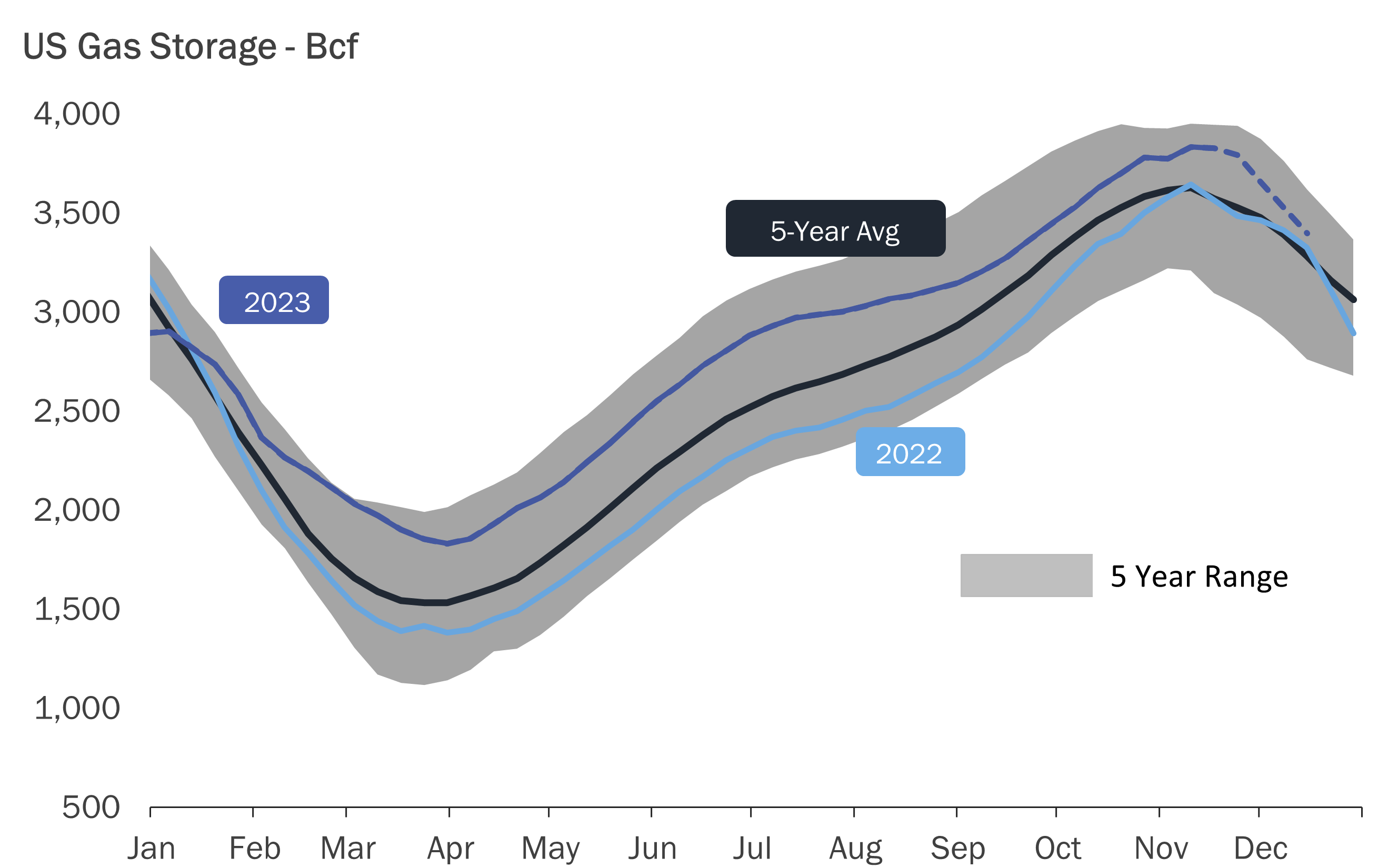

(2) we were lucky: Q1 2024 turned out to be once again a rather mild winter, with no sudden demand shocks in Europe;

(3) LNG traders are getting creative, with swap arrangements often optimising shipping routes;

(4) strong LNG carrier capacity additions: over 60 LNG carriers are expected to hit the waters, which means that carrier capacity is expanding this year more rapidly than LNG supply. This in turn keep in check LNG carrier charter rates.

While the Red Sea crisis had limited implications so far, it is a stark reminder that geopolitics continue to weigh on gas market. The recent attack on Ukrainian gas storage is another reminder…

What is your view? How will gas markets evolve this summer? What will be the impact of geopolitics? Do you see any imminent risk factors?

Source: Greg MOLNAR