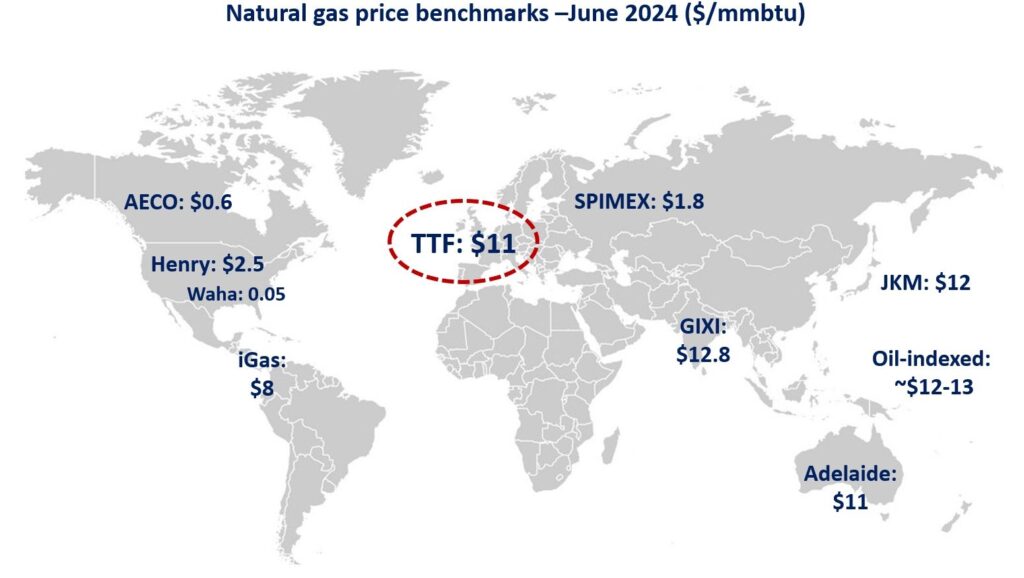

Gas prices continued to strengthen across all key gas regions in June, reflecting tighter market fundamentals.

In the US, Henry Hub jumped by 20% month-on-month to average at $2.5/mmbtu -which is close to the average breakeven cost of US gas producers. production cuts, together with strong gas-fired powgen (up by 5% yoy) and higher exports provided upward pressure on gas prices.

In contrast, in Canada there is no relief from oversupply and high storage levels, with AECO prices plunging by 36% month-on-month to an average of just $0.6/mmbtu and guess what, this is not even the cheapest gas… in Waha gas prices averaged close to 0/mmbtu -still a relief from the previous few months, when Waha was trading in deep negative territory.

In Europe, TTF prices rose by 8% to near $11/mmbtu, despite weak demand and high storage levels. lower LNG inflows, unplanned outages, geopolitical uncertainties all supported higher gas prices in Europe. together with lower carbon prices, gas-fired powgen now seems to be less competitive than the most efficient coal-fired power plants…

In Asia, JKM prices rose by more than 10% to just above $12/mmbtu -nearing the average of oil-indexed LNG prices. tighter LNG supply availability (due to outages in Australia, the US and feedgas issues in Egypt) together with very strong demand from India (up by a whooping 50% yoy) provided upward pressure on Asian prices. but are we nearing a price level which would be difficult to sustain for some of the most price sensitive Asian markets?

Source: Greg Molnar