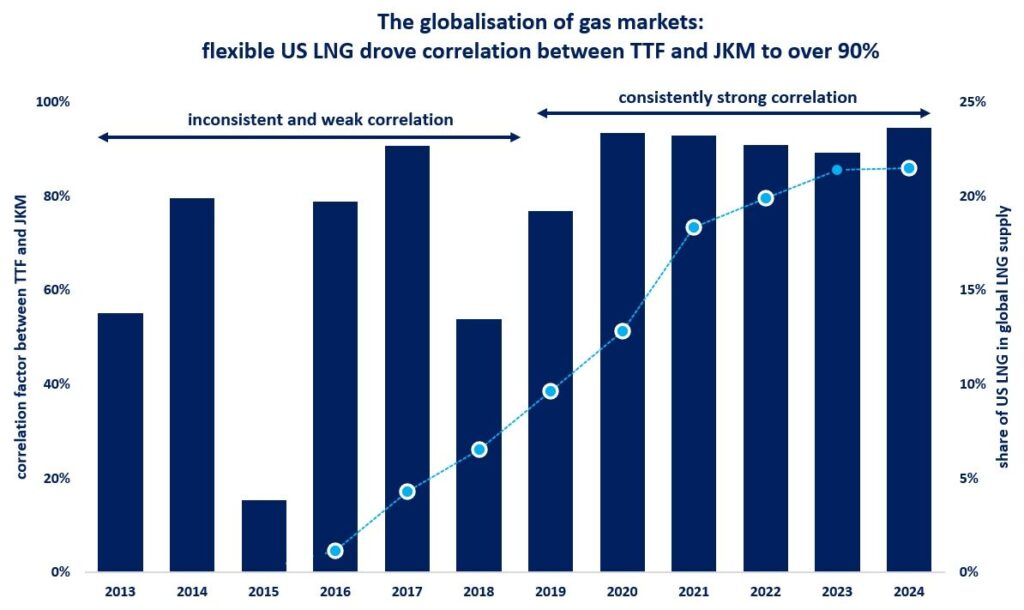

US LNG emerged as the single most important driver behind the globalisation of gas markets, contributing to gas supply security not only in volumetric terms but also in terms of flexibility.

The US LNG exports boomed since 2016, with the country becoming the world’s largest LNG exporter in 2023, with a market share of just over 20%.

The unique commercial terms underpinning US LNG supply, hub-indexation and destination-flexibility, profoundly transformed global gas markets.

The destination freedom embedded in US LNG contracts allowed for a more intimate interplay between regional gas markets and ultimately supported the globalisation of the LNG market.

A key indicator of that is the increasingly strong correlation between TTF and JKM, which rose from an average of 65% between 2013-19 to just over 90% through 2020-24. the correlation remained relatively strong in 2022, despite the all-time price volatility during the darkest days of the gas crisis.

The flexibility provided by US LNG was crucial in the response to the gas supply shock of 2022, with Europe hiking up its LNG imports by more than 60% -mainly from the US. this strong LNG inflow, the European market would have been left in a significantly more vulnerable position, with an increased risk of gas supply disruption.

US LNG is expected to support further global gas market integration, with the US alone accounting for almost 40% of the LNG capacity currently under construction.

Source: Greg Molnar