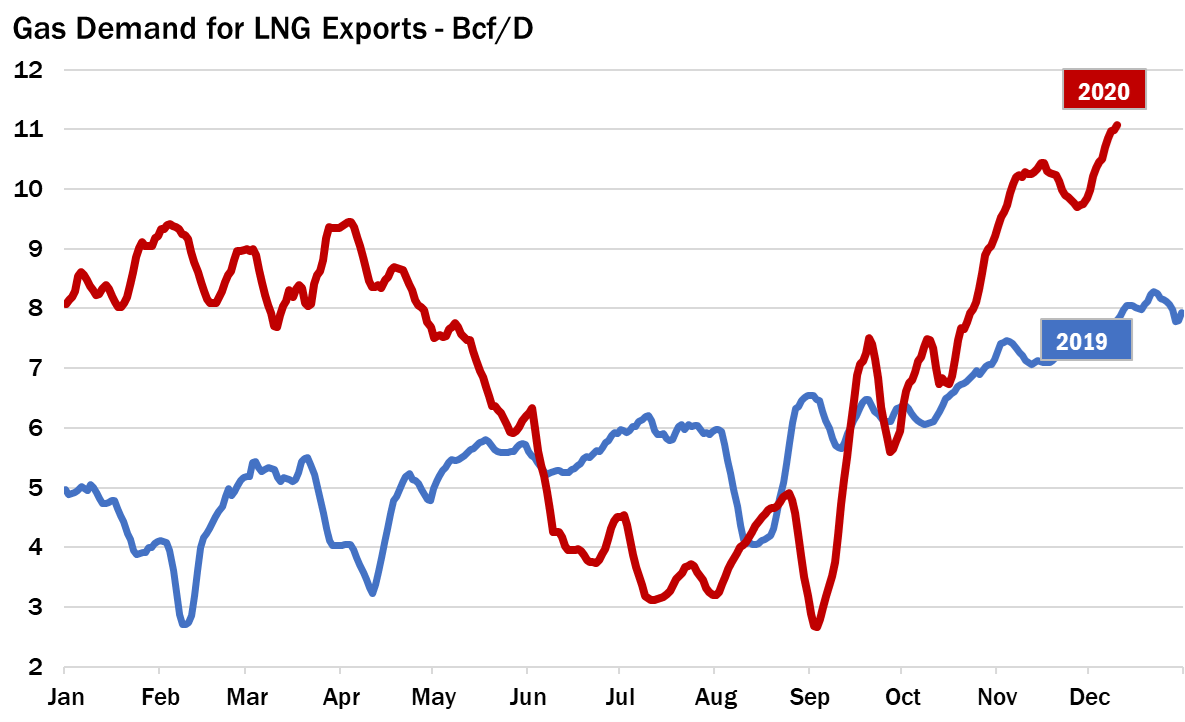

US exports of the chilled fuel could nearly double from last year’s total to almost 230bcm in 2030, should Trump deliver on his campaign promise of fast-tracking LNG permitting, the firm said in a note.

“Europe stands to be a significant beneficiary of Trump’s LNG expansion policies, particularly as the EU strives to further reduce reliance on Russian gas,” it said.

LNG was set to play a significant role in upcoming trade negotiations with Europe, it added.

The EU would have to sanction Russian LNG to increase US supplies and improve relations ahead of potential tariffs, Montel reported earlier this month.

Photo: Evan El-Amin/Shutterstock.com

Bargaining chip

“The Trump administration could leverage LNG as a bargaining chip in trade negotiations with Europe, Russia and other major economies,” the firm said, adding that a renewed tariff war with China could also shake up markets.

Trump said on Monday that he intends to impose a 10% tariff, on top of existing levies, on China as one of his first measures.

Trump’s tariffs in his first administration affected LNG costs and trade, Rystad said, noting that a 25% steel tariff implemented in 2018 led to significant price increases for LNG projects.

“[This] trend that could repeat under Trump 2.0.”

Oversupply?

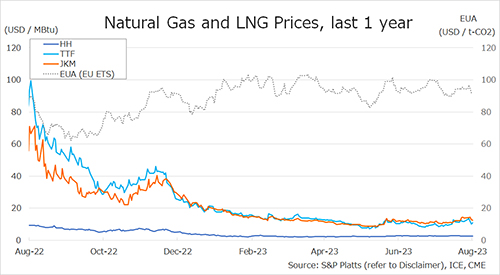

There was a risk the rapid expansion in supply could prove bearish for the market, as it attempts to absorb the additional volumes, Rystad said.

“An untimely supply boost will heighten the risk of a medium-term market glut, which would put downward pressure on prices” and put US producers at disadvantage to competitors like Qatar and Australia.

Global LNG demand expected to reach almost 820bcm (600m tonnes) in 2030, however a supply gap of 190bcm could open in 2035, based on current project development plans, Rystad said.

“However, reliable US supply would also unlock new demand, particularly from price sensitive markets in Asia, if executed strategically,” it said.

Source: Montel News