Associated gas production in the Permian basin continued to grow strongly in 2024, with the region’s total dry gas output soaring by 10% and set to reach a record high of over 185 bcm – roughly equating to Canada’s total natural gas output.

The Permian love story has been going on now for more than a decade: since 2013, the region’s oil production rose by eightfold, while dry gas output surged by more than tenfold, on the back of the US formidable shale revolution.

Today, the Permian alone accounts for more than 40% of the US crude oil production and to almost 18% of the country’s dry gas output (not too bad for an “oil region”).

The correlation between oil and gas production is over 0.8, an extremely strong factor, highlighting the intimate interplay between tight oil and associated gas.

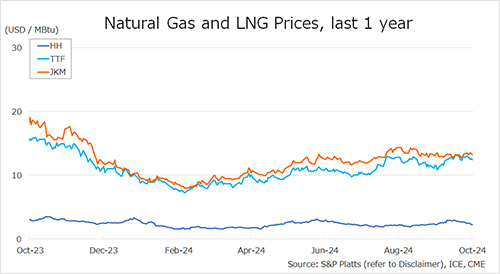

Essentially being a byproduct of oil, associated gas in the Permian does not respond anymore to gas economics: production has been growing even during those months when Waha gas prices plunged to negative territory, with Permian upstreamers practically paying for buyers to take their gas… something which don’t happen too often outside the Permian.

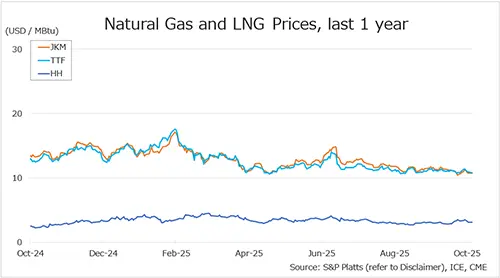

And while Permian gas production continued to grow, dry gas producers in Haynesville and even in the Marcellus were shutting in production when Henry Hub prices collapsed to below $2/mmbtu earlier this year.

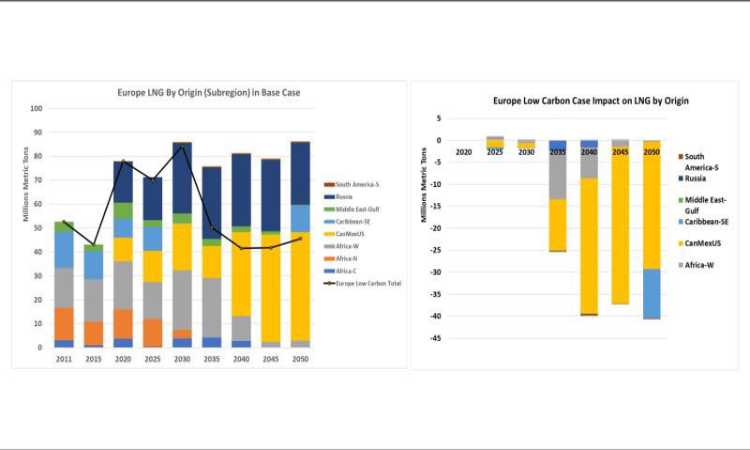

And there are good reasons to believe that the Permian love story will continue: oil wells in the Permian are becoming gassier, with the gas-to-oil ratio rising by 30% since 2013, meaning that more associated gas is yet to come, feeding both the domestic market and LNG exports.

Very importantly, the growing role of Permian gas is set to put downward pressure on US gas prices and keep them highly competitive.

What is your view? How will Permian oil and gas dynamics evolve? Could associated gas feed the AI revolution, and the growing energy needs of data processing? Will Waha be more positive in 2025 as takeaway capacity is catching up?

Source: Greg MOLNAR