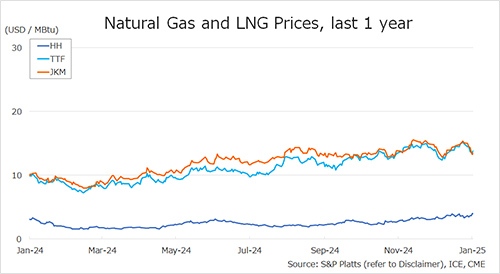

The Northeast Asian assessed spot LNG price JKM (February delivery) for last week (6 – 10 January) fell to low-USD 13s on 10 January from low-USD 15s the previous weekend (3 January). JKM was trending lower throughout the week as demand in Northeast Asia remained weak and dropped from high prices at the start of the year.

METI announced on 8 January that Japan’s LNG inventories for power generation as of 5 January stood at 1.87 million tonnes, down 0.37 million tonnes from the previous week.

The European gas price TTF (February delivery) for last week (6 – 10 January) fell to USD 13.6/MBtu on 10 January from USD 15.0/MBtu the previous weekend (3 January). Despite the announcement of unplanned maintenance in Norway, TTF was on a downward trend due to mild weather generally and stable supply.

According to AGSI+, the EU-wide underground gas storage was 67.0% on 10 January, down from 70.8% at the end of the previous weekend.

The U.S. gas price HH (February delivery) for last week (6 – 10 January) rose to USD 4.0/MBtu on 10 January from USD 3.4/MBtu the previous weekend (3 January). The demand for feed gas from major U.S. liquefaction terminals is growing, mainly due to the start-up of Plaquemines LNG.

The EIA Weekly Natural Gas Storage Report released on 8 January showed U.S. natural gas inventories as of 3 January at 3,373 Bcf, down 40 Bcf from the previous week, down 0.1% from the same period last year, and 6.5% increase over the five-year average.

Source: JOGMEC