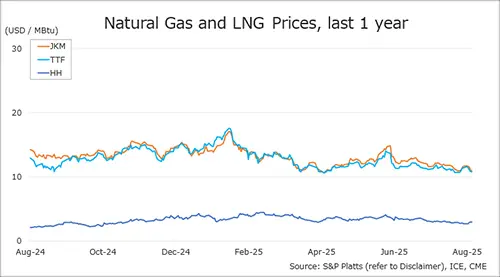

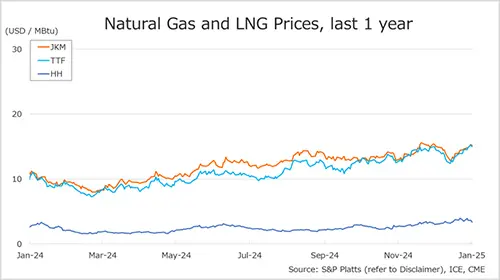

The Northeast Asian assessed spot LNG price JKM (February delivery) for the two-week period around the New Year (23 December – 3 January) rose to low-USD 15s on 3 January from high-USD 13s the previous weekend (20 December).

JKM continued to rise due to growing supply concerns in Europe due to the expiration of the gas transit agreement between Russia and Ukraine, while the situation of high inventory and sluggish demand in Northeast Asia remains unchanged. METI announced on 25 December that Japan’s LNG inventories for power generation as of 22 December stood at 2.07 million tonnes, down 0.16 million tonnes from the previous week.

The European gas price TTF for the two-week period around the New Year (23 December – 3 January) rose to USD 15.0/MBtu (February delivery) on 3 January from USD 13.4/MBtu the previous weekend (January delivery, 20 December).

TTF rose due to increased supply uncertainty after Russian gas supplies to Europe via Ukraine were reduced to zero from January 1. The amount of gas supplied via Ukraine was equivalent to around 12-13 LNG cargoes per month. According to AGSI+, the EU-wide underground gas storage was 70.8% on 3 January, down from 76.1% on 20 December.

The U.S. gas price HH for last week (23 December – 3 January) rose to USD 3.4/MBtu (February delivery) on 3 January from USD 3.3/MBtu the previous weekend (January delivery, 20 December). The feed gas deliveries to major US liquefaction terminals averaged nearly 15.20Bcf/d during the week to 31 December, up from 14.85Bcf/d in the previous week.

Venture Global’s Plaquemines LNG shipped its first cargo to German utility EnBW on 26 December. The EIA Weekly Natural Gas Storage Report released on 3 January showed U.S. natural gas inventories as of 27 December at 3,413 Bcf, down 116 Bcf from the previous week, down 1.9% from the same period last year, and 4.7% increase over the five-year average.

Updated: January 06

Source: JOGMEC