Even with fluctuations in the near-term temperature outlook, the general temperature pattern over the course of the 15-day outlook is supportive of ramped-up natural gas cooling demand.

The current gas weighted degree days (GWDDs) for the period of August 2-15 is the second most for the period in the last five years, even when accounting for the potential cool down in temperatures at the end of the first week of August.

When taking into consideration the continuation of hot summer temperatures combined with a storage deficit versus the five-year average that is just south of 350 Bcf, it doesn’t take much to spark a buying spree.

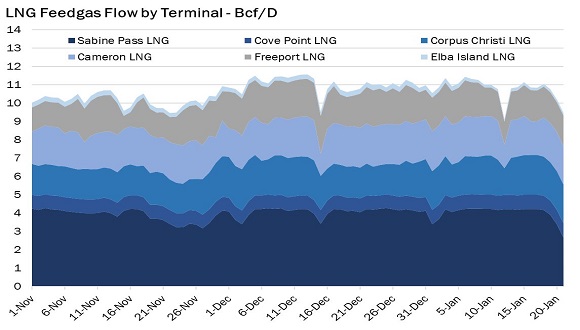

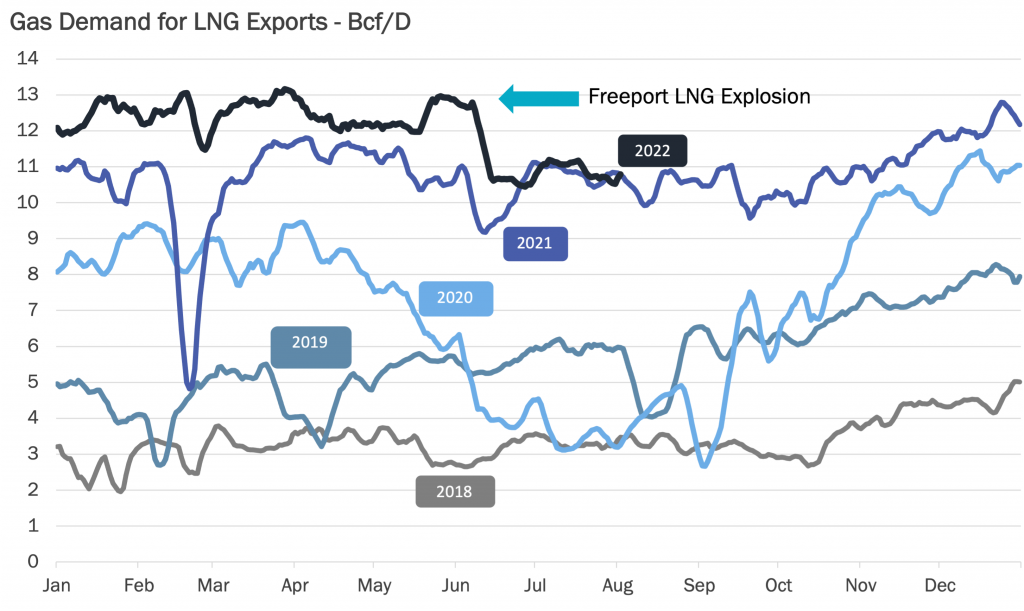

As was witnessed yesterday, the timing of the rally in prices, which climbed to an intraday high of $8.298/MMBtu, appeared to be based on a news blip that the Freeport LNG will be coming back online in October.

While this wasn’t exactly new news to the market, what the blip failed to mention is that if the LNG facility comes back in October it is slated to only be partially operational, processing a much smaller percentage of daily volumes compared to volumes prior to the early June outage.

With all of this in mind, it seems that NYMEX front-month gas futures priced at $8.30/MMBtu (or higher) for the month of September is excessive.

This is particularly the case when taking into consideration that dry gas production is wobbling at record highs near 97.5 Bcf/d and looks to see even more growth in the relative near-term with some modeling that suggests volumes will surpass 98 Bcf/d in the weeks ahead.

This coupled with a seasonal transition in temperatures to cooler conditions as the calendar presses forward will only create larger weekly storage builds in the relative near-term, all of which is not bullish for prices.

Until the summer heat relents, it seems that the market would be more appropriately priced in the $7.00/MMBtu to $7.50/MMBtu area, which is a price area that has been seen in the past when similar weather, storage, and supply/demand fundamentals were in play.

Source: Gelber and Associates