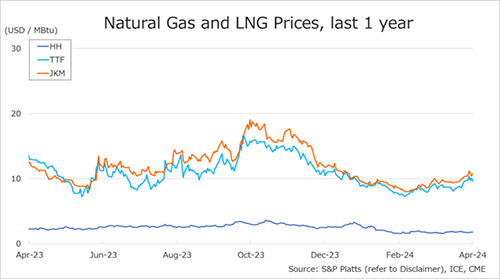

The Northeast Asian assessed spot LNG price JKM for the previous week (15 April – 19 April) increased to high-USD 10s on 19 April from low-USD 10s the previous weekend.

In the first half of the week, the price surged to low-USD 11s on April 16 due to escalating tensions in the Middle East and supply risks such as the shutdown of Freeport LNG train 3 in the US and unplanned maintenance at the Nyhamna gas processing plant in Norway.

The price remained at 10s through the latter half of the week, despite ongoing tensions in the Middle East, due in part to weak demand in Asia. METI announced on 17 April that Japan’s LNG inventories for power generation as of 14 April stood at 1.61 million tonnes, unchanged from the previous week.

The European gas price TTF for the previous week remained unchanged at USD 9.6/MBtu on April 19 from USD 9.6/MBtu the previous weekend.

European gas prices surged to USD 10.3/MBtu in the first half of the week due to escalating tensions in the Middle East and the shutdown of LNG facilities in the US and unplanned maintenance in Norway, but prices fell in the latter half of the week on weak fundamentals.

According to AGSI+, the EU-wide underground gas storage increased to 62.0% as of 19 April from 61.4% the previous week.

The U.S. gas price HH remained unchanged at USD 1.8/MBtu on 19 April from USD 1.8/MBtu the previous weekend.

HH stabilized at low levels due to low demand and high inventories. The EIA Weekly Natural Gas Storage Report released on 18 April showed U.S. natural gas inventories as of 12 April at 2,333 Bcf, up 50 Bcf from the previous week, up 22.2% from the same period last year, and 36.4% increase over the five-year average.

Updated: 22 April 2024

Source: JOGMEC