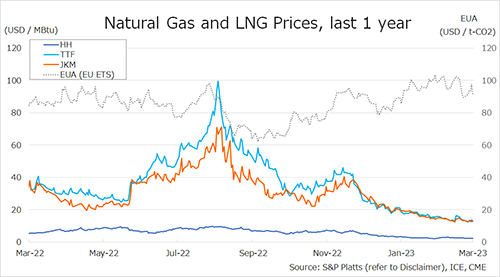

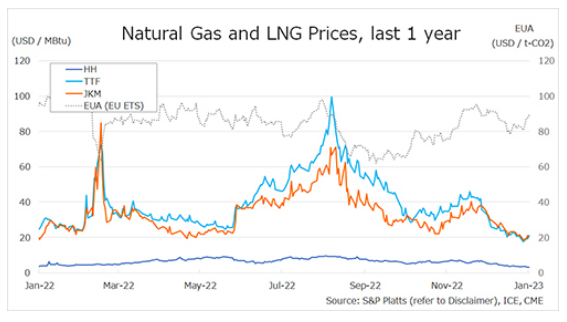

The Northeast Asian assessed spot LNG price JKM for the previous week (16 January – 20 January) fell for two consecutive business days to USD 18.4/MBtu on 17 January from USD 21.8/MBtu the previous week amid relatively mild winter temperatures in Asia and a lull in spot trading ahead of the Chinese New Year holiday in China and Korea.

It then rose for two consecutive business days due to a rebound in European gas prices and the arrival of cold weather in Asia, reaching USD 21.1/MBtu on 19 January, but fell back to USD 20.5/MBtu on 20 January.

According to METI, Japan’s LNG inventories for power generation totaled 2.62 million tonnes as of 15 January, up 0.14 million tonnes from the previous week, up 0.82 million tonnes from the end of the same month last year and up 0.95 million tonnes from the average of the past five years, indicating a steady inventory.

The European gas price TTF fell to USD 17.6/MBtu on 16 January from USD 20.5/MBtu the previous week amid milder-than-usual weather, high European underground gas storage, strong UK wind power generation, and steady LNG supplies.

TTF then rose for two consecutive business days, hitting USD 19.6/MBtu on 18 January due to increased heating demand due to cold weather and reduced gas supply following the annual maintenance of gas facilities in Norway.

On 19 January, TTF fell slightly to USD 19.2/MBtu, but rose the next day to USD 21.2/MBtu on forecasts of cooler temperatures in northwest Europe and lower Russian gas supplies to Ukraine.

ACER has started publishing European delivery spot LNG assessment prices and announced EUR 57.01/MWh (USD 18.09/MBtu) for Northwest Europe on 20 January. According to AGSI+, EU-average underground gas storage was 78.87% as of 20 January, down from 81.88% the previous week.

The U.S. gas price HH rose to USD 3.6/MBtu on 17 January from USD 3.4/MBtu the previous week.

It then declined slightly for three consecutive business days to USD 3.2/MBtu on 20 January. According to the EIA Weekly Natural Gas Storage Report released on 19 January, the U.S. natural gas underground storage on 13 January was 2,820 Bcf, down 82 Bcf from the previous week, down 0.7% from the same period last year, and up 1.2% from the historical five-year average.

Updated 23 January 2023

Source: JOGMEC