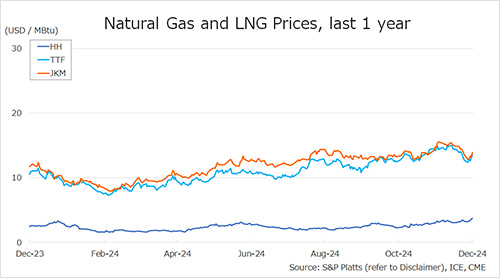

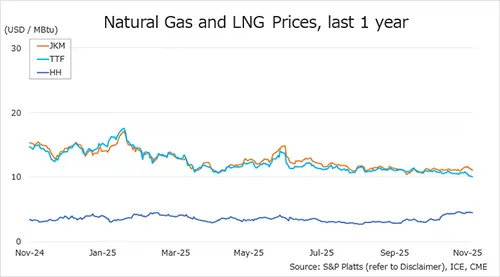

Global gas prices diverged last week as stronger Asian LNG contrasts with softer European TTF and steady US Henry Hub.

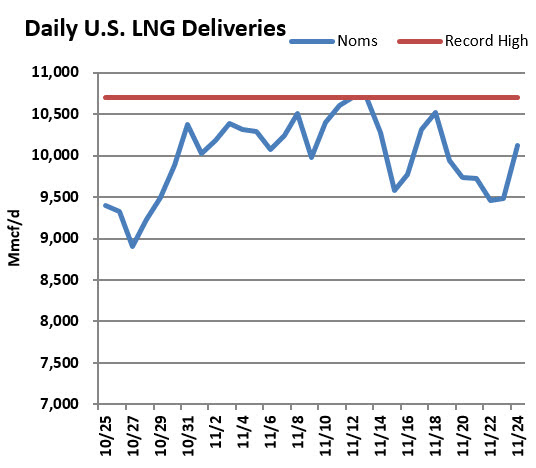

The Northeast Asian spot LNG marker JKM jumped to mid-USD 11s/MBtu on 21 November (January delivery), from high-USD 10s/MBtu the previous weekend, helped by widening Asia–Europe spreads and a shortage of available LNG carriers as US export volumes surged.

There was some volatility mid-week, with JKM reaching high-USD 11s on 20 November before returning to mid-USD 11s amid weak demand in parts of Asia. Japanese power-sector inventory data showed LNG stocks rising to 2.23 Mt as of 16 November (+0.27 Mt week-on-week).

In Europe, the TTF December contract fell to USD 10.2/MBtu by 21 November, down from USD 10.7/MBtu the prior weekend. Prices had briefly risen to 10.8 on 18 November in light of colder forecast patches and potential dips in wind output.

But stable pipeline flows — notably from Norway — along with brisk US LNG deliveries weighed on prices as the week progressed. EU storage levels dropped slightly to 79.6 %, reflecting a tightening compared with last week and a notable drop compared with last year.

In the United States, Henry Hub cash prices (December delivery) ended the week at USD 4.6/MBtu, unchanged from the previous weekend.

Prices dipped to 4.4 on 17 November in response to warmer forecasts in some regions, but picked up again mid-week as cooler weather moved in across parts of the central and eastern US, combined with the first seasonal storage withdrawal — inventories fell to 3,946 Bcf.

Source: JOGMEC