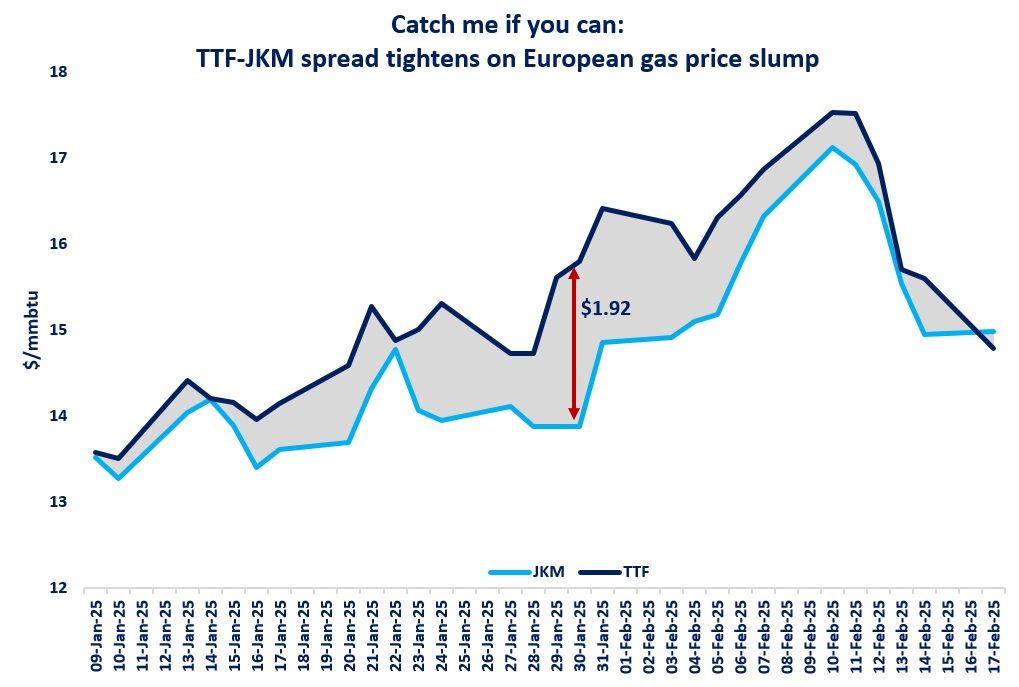

The Northeast Asian assessed spot LNG price JKM (November delivery) for last week (22 – 26 September) fell to low-USD 11s/MBtu on 26 September from mid-USD 11s/MBtu the previous weekend (19 September). Spot LNG demand in Northeast Asia remained weak, due to ample LNG inventories and sufficient supply in the region.

With little change in fundamentals, the price showed only minor fluctuations throughout the week. METI announced on 24 September that Japan’s LNG inventories for power generation as of 21 September stood at 1.88 million tonnes, up 0.13 million tonnes from the previous week.

The European gas price TTF (October delivery) for last week (22 – 26 September) rose to USD 11.2/MBtu on 26 September from USD 11.1/MBtu the previous weekend (19 September). In both Northwest and South Europe, gas demand increased due to below-average temperatures.

However, steady supply from Norwegian continental shelf, and the price remained mostly flat, moving in a narrow range between USD 11 and the low-USD 11s without significant movement. According to AGSI+, the EU-wide underground gas storage was 82.2% on 26 September, up from 81.4% the previous weekend, down 13.1% from the same period last year, and down 7.1% over the five-year average.

The U.S. gas price HH (October delivery) for last week (22 – 26 September) fell to USD 2.8/MBtu on 26 September from USD 2.9/MBtu the previous weekend (19 September). In the U.S., mild weather is expected to continue across much of the country, leading to weak gas demand.

The EIA Weekly Natural Gas Storage Report released on 25 September showed U.S. natural gas inventories as of 19 September at 3,508 Bcf, up 75 Bcf from the previous week, up 0.6% from the same period last year, and 6.1% increase over the five-year average. The latest storage report showed inventory levels surpassing those of the same period last year.

Updated: September 29

Source: JOGMEC