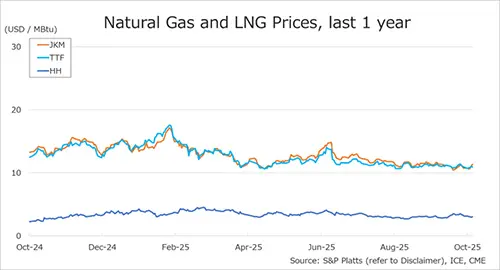

Asian LNG prices gains on winter demand concerns, while European benchmarks held steady and U.S gas eased on mild weather and ample supply.

The Northeast Asian assessed spot LNG price JKM for last week (13 – 17 October) rose to mid-USD 11s/MBtu on 17 October (December delivery) from high-USD 10s/MBtu the previous weekend (10 October, November delivery).

JKM fell to mid-USD 10s/MBtu in the first half of the week due to sluggish demand and easing geopolitical risks following the Gaza ceasefire, but then rose to mid-USD 11s/MBtu due to concerns over uncertainty caused by UK sanctions on China’s Beihai LNG terminal and the approaching of the high-demand winter season.

METI announced on 15 October that Japan’s LNG inventories for power generation as of 12 October stood at 1.90 million tonnes, up 0.04 million tonnes from the previous week.

The European gas price TTF (November delivery) for last week (13 – 17 October) was almost unchanged at USD 10.9/MBtu on 17 October from USD 10.9/MBtu the previous weekend (10 October). TTF continued to rise modestly due to forecasts of lower temperatures and a temporary supply reduction from the Norwegian continental shelf, but fundamentals remained generally stable, and prices turned lower on 17 October, supported by solid supply from Norway.

According to AGSI+, the EU-wide underground gas storage was 82.8% on 17 October, down from 82.9% the previous weekend, down 13.4% from the same period last year, and down 8.9% over the five-year average. The storage level reached 83.2% on 12 October and has declined for five consecutive days since then.

The U.S. gas price HH (November delivery) for last week (13 – 17 October) fell to USD 3.0/MBtu on 17 October from USD 3.1/MBtu the previous weekend (10 October). HH continued its downward trend due to forecasts of mild weather and robust supply fundamentals, falling to USD 2.9/MBtu on 16 October, but it rebounded slightly to USD 3.0/MBtu on 17 October due to short-term forecasts of lower temperatures.

The EIA Weekly Natural Gas Storage Report released on 16 October showed U.S. natural gas inventories as of 10 October at 3,721 Bcf, up 80 Bcf from the previous week, up 0.7% from the same period last year, and 4.3% increase over the five-year average.

Updated: October 20

Source: JOGMEC