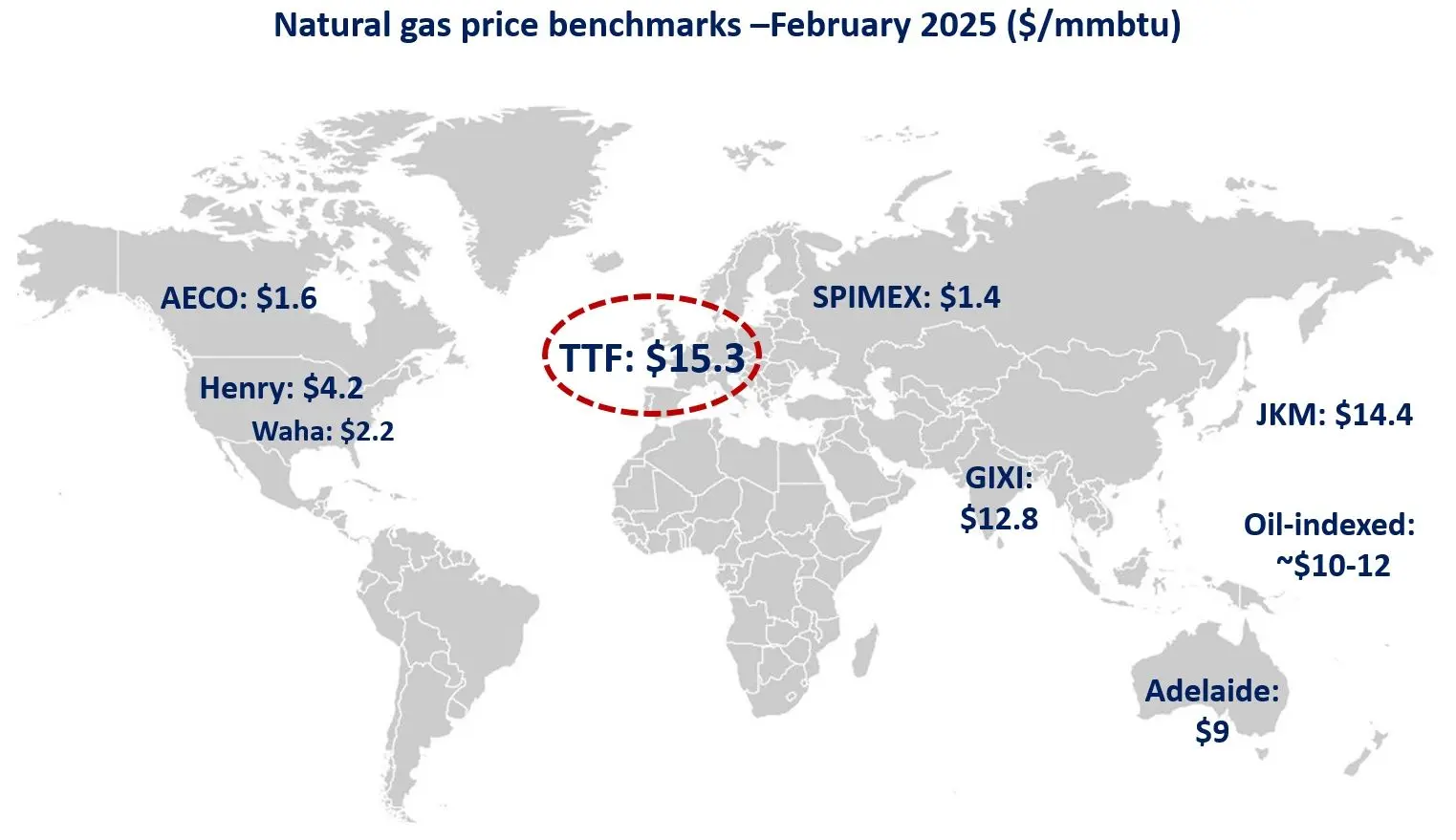

JKM prices break above the oil-indexed range for the first time since mid-December last year, highlighting rapidly tightening market fundamentals ahead of the Asian cooling season.

JKM prices rose by more than 60% since early March, driven by strong demand growth in Asia, tighter supply than expected and geopolitics adding to the nervousness of the market:

(1) Asian demand: both China and India’s gas demand growth is back to double-digit growth, primarily supported by industry and higher gas burn in the power sector;

(2) Sizzling heatwaves are adding to the overall gas/LNG demand: India’s gas-fired powgen doubled through Apr-May to reach multi-year highs amid surging cooling demand;

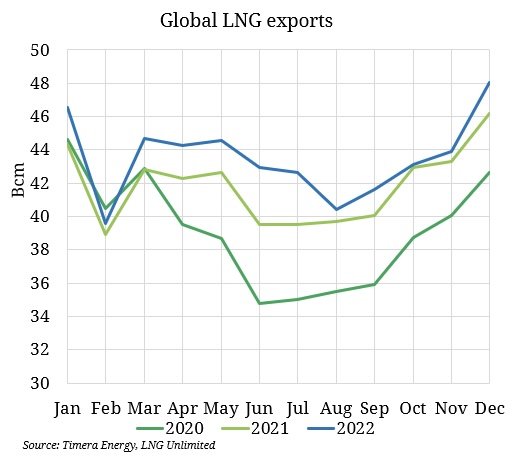

(3) Tighter supply than expected: the delay of certain projects (Tortue FLNG), together with the uncertain fate of Arctic LNG 2 led to tighter supply fundamentals;

(4) Sub-optimal shipping routes: droughts at Panama Canal, geopolitical tensions along the Red Sea made increasingly difficult to bring US LNG to Asia markets. improving water levels at Panama could help with this.

(5) Unexpected outages: recent outages at Wheatstone and Brunei added to the short-term supply concerns and are fuelling additional price volatility;

(6) Geopolitics: uncertainties around Russian piped gas to Europe, Middle East tensions are adding to the market’s nervousness.

With JKM now back above the average oil-indexed LNG price, Asian buyers will have a greater incentive to use any remaining upward nominations under their oil-indexed long-term LNG contracts.

Moreover, the current price level of above $11-12/mmbtu might not be affordable to certain price sensitive buyers. Pakistan just announced that it does not plan more spot procurements through the summer. others might follow…

Source: Greg Molnár