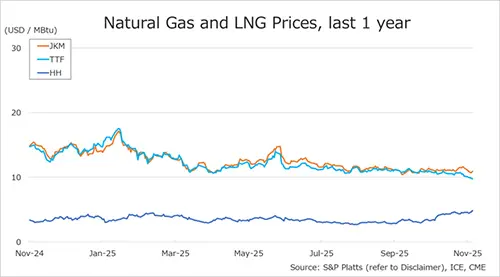

Global gas prices moved lower in Asia and Europe last week on mild demand and stable supply, while US prices rose on stronger LNG exports and colder weather expectations.

Asia

The Northeast Asian assessed spot LNG price JKM (January delivery) for last week (24–28 November) fell to the high-USD 10s/MBtu on 28 November from the mid-USD 11s/MBtu the previous weekend (21 November). JKM remained on a downward trend early in the week as end-users in Northeast Asia continued to hold ample inventories amid weak demand.

Toward the end of the week, prices rebounded modestly on uncertainty surrounding Ukraine–Russia peace negotiations and the potential for stronger winter demand. Overall, JKM largely hovered in the high-USD 10s/MBtu throughout the week. METI announced on 26 November that Japan’s LNG inventories for power generation as of 23 November stood at 2.13 million tonnes, down 0.11 million tonnes from the previous week.

Europe

The European gas price TTF for last week (24–28 November) fell to USD 9.8/MBtu on 28 November (January delivery) from USD 10.2/MBtu the previous weekend (21 November, December delivery). TTF remained on a downward trend throughout the week due to stable supplies from Norway and forecasts of rising temperatures in Northwestern Europe.

According to AGSI+, EU-wide underground gas storage was 76.1% on 28 November, down from 79.6% the previous weekend, 12.2% lower than the same period last year, and 11.8% below the five-year average.

United States

The US gas price Henry Hub (HH) for last week (24–28 November) rose to USD 4.9/MBtu on 28 November (January delivery) from USD 4.6/MBtu the previous weekend (21 November, December delivery). HH increased on the back of higher LNG exports and expectations of colder temperatures in the coming weeks, reaching its highest level since December 2022.

The EIA Weekly Natural Gas Storage Report released on 26 November showed US natural gas inventories as of 21 November at 3,935 Bcf, down 11 Bcf from the previous week (the first withdrawal of the season), 0.8% below the same period last year and 4.2% above the five-year average.

Source: JOGMEC