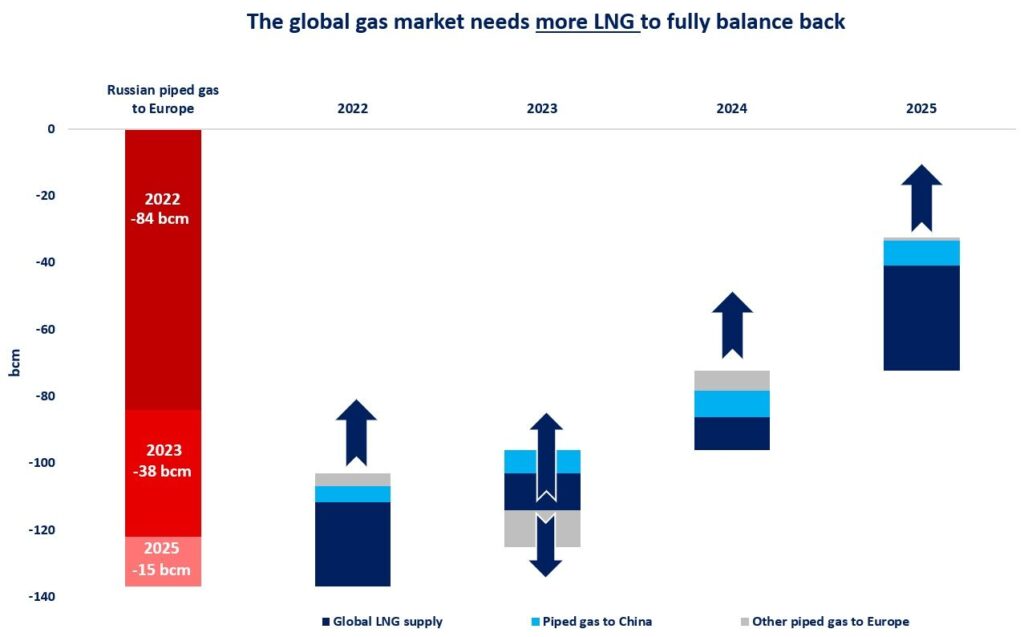

Global gas trade is still recovering from the 2022/23 gas supply shock, with more time and more LNG needed to make-up for the lost Russian volumes.

Russian piped gas deliveries to Europe fell by more than 120 bcm between 2022/23, equating to approximately one-fifth of the global LNG market.

In addition, Russian piped gas deliveries could decline by a further 15 bcm in 2025, after the expiry of the Russian-Ukraine transit contract.

So, altogether almost 140 bcm of Russian gas supply is lost to Europe and consequently to the global gas balance.

Meanwhile, global LNG supply growth was lacklustre over these years, with less than 50 bcm of incremental supply added to the market through 2022-24.

The other major source of incremental gas supply was Russia itself, ramping-up its piped gas deliveries to China by 20 bcm through 2022-24, via the Power of Siberia pipeline system.

After these dry years, LNG supply growth is set to accelerate in 2025, with around 30 bcm of additional supply expected to hit the market on the back of new major LNG projects, such as Plaquemines or LNG Canada.

Also, Power of Siberia is set to reach its nameplate capacity in 2025, adding around 8 bcm of gas to China’s

supply mix.

Despite this stronger growth, the global gas market will be still short in 2025 by around 30 bcm compared to the pre-crisis supply levels.

More time and more LNG will be needed to fully balance back: Qatar’s North Field expansion and the ramp-up of the new US LNG projects in 2026 will be key to put us back on track for a more balance gas market in the second half of the decade.

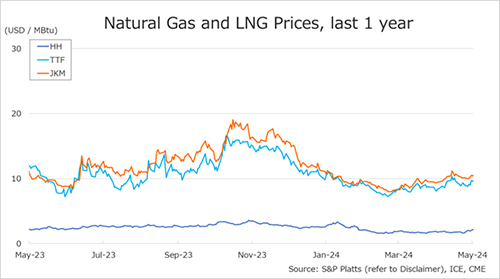

Meanwhile, 2025 might be well characterised by relatively tight market conditions and with price volatility spiced up with growing geopolitical tensions.

What is your view? How will gas market fundamentals evolve next year? How much additional LNG is needed to balance back? And what is your guess on Ukrainian transit?

Source: Greg MOLNAR