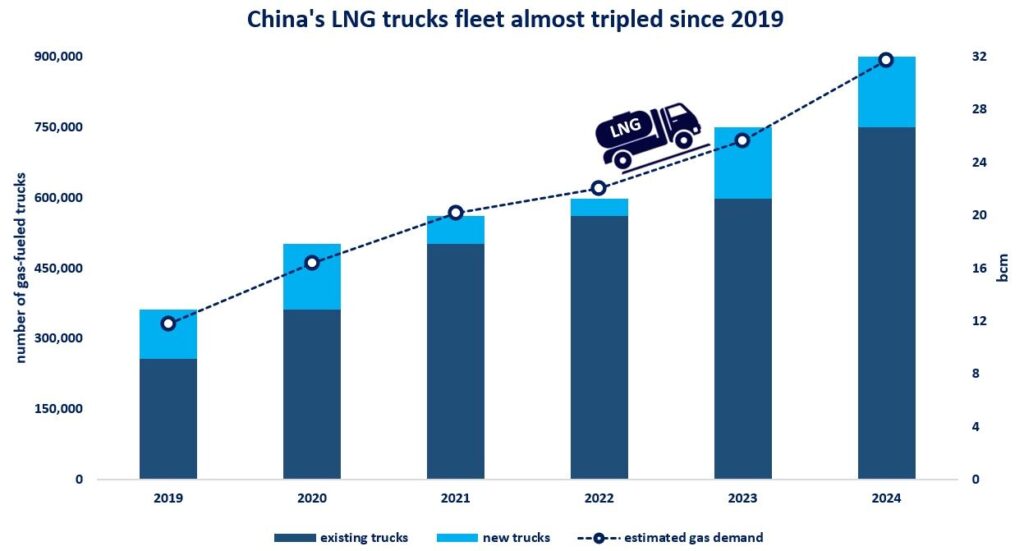

China’s LNG truck fleet almost tripled since 2019, with their number expected to reach 1 million in 2025, further adding to China’s rapidly rising gas demand.

China’s gas-fueled truck sales have been booming in recent years, supported by a tightening emissions regulations (China VI-b), subsidies, effective development of fuel stations and domestic LNG prices outcompeting diesel.

All in all, LNG truck sales grew by almost 40% yoy in Q1-3 2024 and accounted for over one-third of total truck sales during this period.

The strong growth in LNG trucks is also driving up China’s gas demand, with their consumption rising by around 20 bcm since 2019 to just over 30 bcm in 2024 (which is equivalent to France’s total gas demand).

Together with EVs, China’s LNG truck boom is also leading to substantial emissions savings, while weighing on the country’s diesel demand: earlier this year, CNPC already projected a potential peak in China’s petroleum products demand by 2025.

Of course, LNG truck sales are highly sensitive to the fluctuation of LNG prices: higher domestic LNG prices weighed on truck sales since July, a downward trend which is expected to continue through the winter season.

This being said, the next LNG mega-wave is set to loosen the market through the second half of the decade, weigh on gas prices and unlock additional pockets of demand, including in road transport.

And India is also looking closely to gas in transport: the country is aiming to convert one-third of its heavy truck fleet of over 7 million to natural gas in the next 5 to 7 years.

And the best thing with gas-fuelled trucks is that they can further contribute to decarbonisation, as they could also run on biomethane (once supplies are scaled-up).

What is your view? What is the future of natural gas in transport? Will LNG trucks conquer Asia? What is the outlook in other markets?

Source: Greg MOLNAR