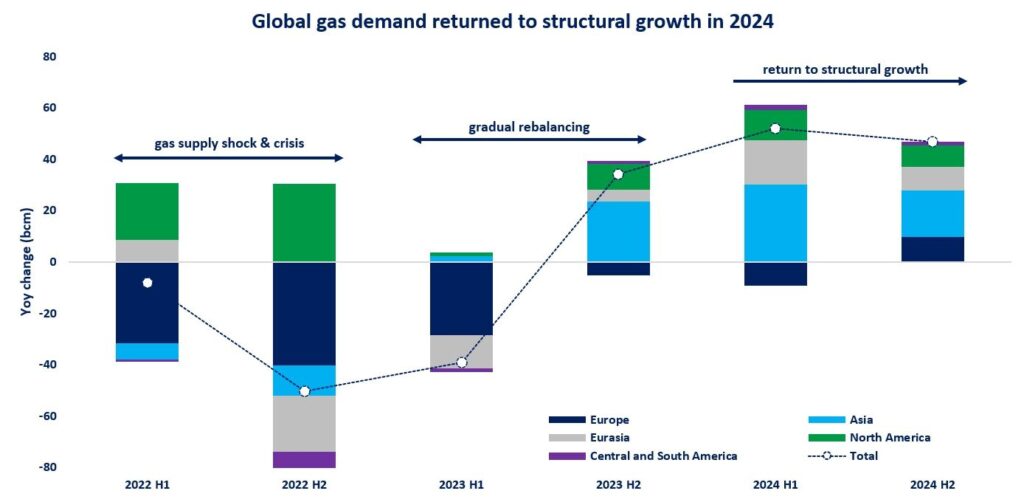

Natural gas markets never get boring and this was certainly true in 2024. and the 5 key developments for me were:

(1) Gas who is back: after two difficult years, natural gas markets returned to structural growth. global gas demand rose by 2.8% in 2024 and met around 40% of incremental energy demand -more than any other fuel;

(2) a global gas market: the correlation between TTF and JKM reached an all-time high of 0.95 – reflecting the growing interconnectivity of regional gas markets (and their interdependence). This is accompanied by a surge in gas trading across all key hubs – partly driven by extra-regional trade volumes;

(3) LNG dry: global LNG supply grew by a mere 10 bcm in 2024 -its lowest growth since 2015 (putting aside the 2020 covid year). project delays, unplanned outages and mounting feedgas issues at legacy producers limited LNG supply growth in 2024 and ultimately tightened up the market;

(4) ship can happen: LNG charters rates collapsed to historical lows in Q4 2024. Slower LNG growth coincided with a strong increase in LNG vessels (+60 new LNG carriers), which naturally depressed charter rates. by the end of November, spot rates for two-stroke vessels fell to an unprecedented $10k/day;

(5) let me flex: extreme weather events in 2024 highlighted the crucial role of gas supply flexibility both for heat and electricity supply security. In the US, daily gas demand hit a record high during Heather Storm, while sizzling heatwaves drove-up gas-fired powgen in India to all-time highs through summer 2024. In Europe, gas burn in the power sector soared by 80% yoy during the November dunkelflaute episodes.

+(1) geopolitical tensions continued to fuel price volatility and provided additional upward pressure on gas prices, through the perceived risk premium. In this context, stronger international cooperation is required to enhance the flexibility of gas and LNG supply chains.

What is your view? Which were the key gas market developments in 2024? And how the market will evolve in 2025?

Source: Greg Molnar