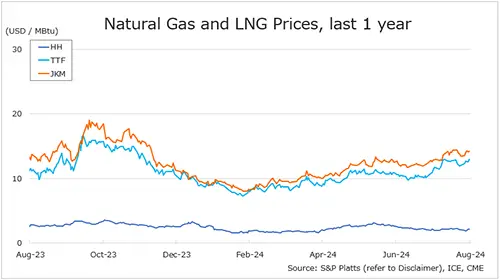

The Northeast Asian assessed spot LNG price JKM (March delivery) for last week (10 – 14 February) fell to high-USD 14s on 14 February from low-USD 16s the previous weekend (7 February).

JKM rose to the low-USD 17s on 10 February, the highest since November 2023, due to high European gas prices. It then continued to move in line with European gas prices as high inventories in Northeast Asia remained unchanged, falling to the high-USD 14s.

METI announced on 12 February that Japan’s LNG inventories for power generation as of 9 February stood at 2.15 million tonnes, down 0.26 million tonnes from the previous week.

The European gas price TTF (March delivery) for last week (10 – 14 February) fell to USD 15.6/MBtu on 14 February from USD 16.9/MBtu the previous weekend (7 February). TTF rose to mid-USD 17s on 10 February due to the forecasts of low temperatures and low renewable energy output, rapid withdrawals from gas storage.

It subsequently trended lower, especially on 13 February, when news that Presidents Trump and Putin had agreed to begin negotiations over a potential end to the war in Ukraine led to a significant decline with the view of declining geopolitical risks. According to AGSI+, the EU-wide underground gas storage was 45.2% on 14 February, down from 30.7% at the end of the previous weekend, down 30.7% from the same period last year, and down 15% over the five-year average.

The U.S. gas price HH (March delivery) for last week (10 – 14 February) rose to USD 3.7/MBtu on 14 February from USD 3.3/MBtu the previous weekend (7 February). HH rose due to the forecasts of low temperatures over a large area of the U.S. in mid-February.

The EIA Weekly Natural Gas Storage Report released on 13 February showed U.S. natural gas inventories as of 7 February at 2,297 Bcf, down 100 Bcf from the previous week, down 9.2% from the same period last year, and 2% decrease over the five-year average.

Updated: February 17

Source: JOGMEC