European LNG imports could surge by more than one-third this summer, translating to around 250 of additional LNG shipments, and tightening up the global gas market.

Low storage levels, less piped gas from Russian and Norway, as well as higher exports to Ukraine are set to drive-up Europe’s LNG import requirements this summer.

While European gas consumption is expected to decline this summer, this would be more than offset by stronger storage injections, which could surge to their second highest in the last 5 years.

EU storage levels just dropped to below 40%, with inventories now standing almost 25 bcm below last year’s levels. this means, that the EU would need to inject almost 20 bcm more gas into storage than in 2024 to reach its 90% storage target.

In addition, EU piped gas imports are expected to decline, amid the halt of Russian piped gas transit via Ukraine (-8 bcm) and lower Norwegian gas output (-3 bcm). the upward flex on TurkStream and from North Africa would fall short in offsetting these loses.

And domestic production is set to further decline, with gas production in the UK Continental Shelf expected to drop by near 10% -Tyra and Sakarya are partly offsetting this loss.

And EU exports to Ukraine are expected to increase strongly this summer. Ukrainian storage levels now dropped to historically low levels, which could translate into an additional injection demand of at least 3 bcm.

In addition, recent Russian attacks damaged upstream production sites, which could potentially reduce Ukraine’s gas output this summer.

Altogether, Europe’s LNG imports could increase by around 25 bcm yoy through the April-October period, translating into an additional 250 LNG shipments.

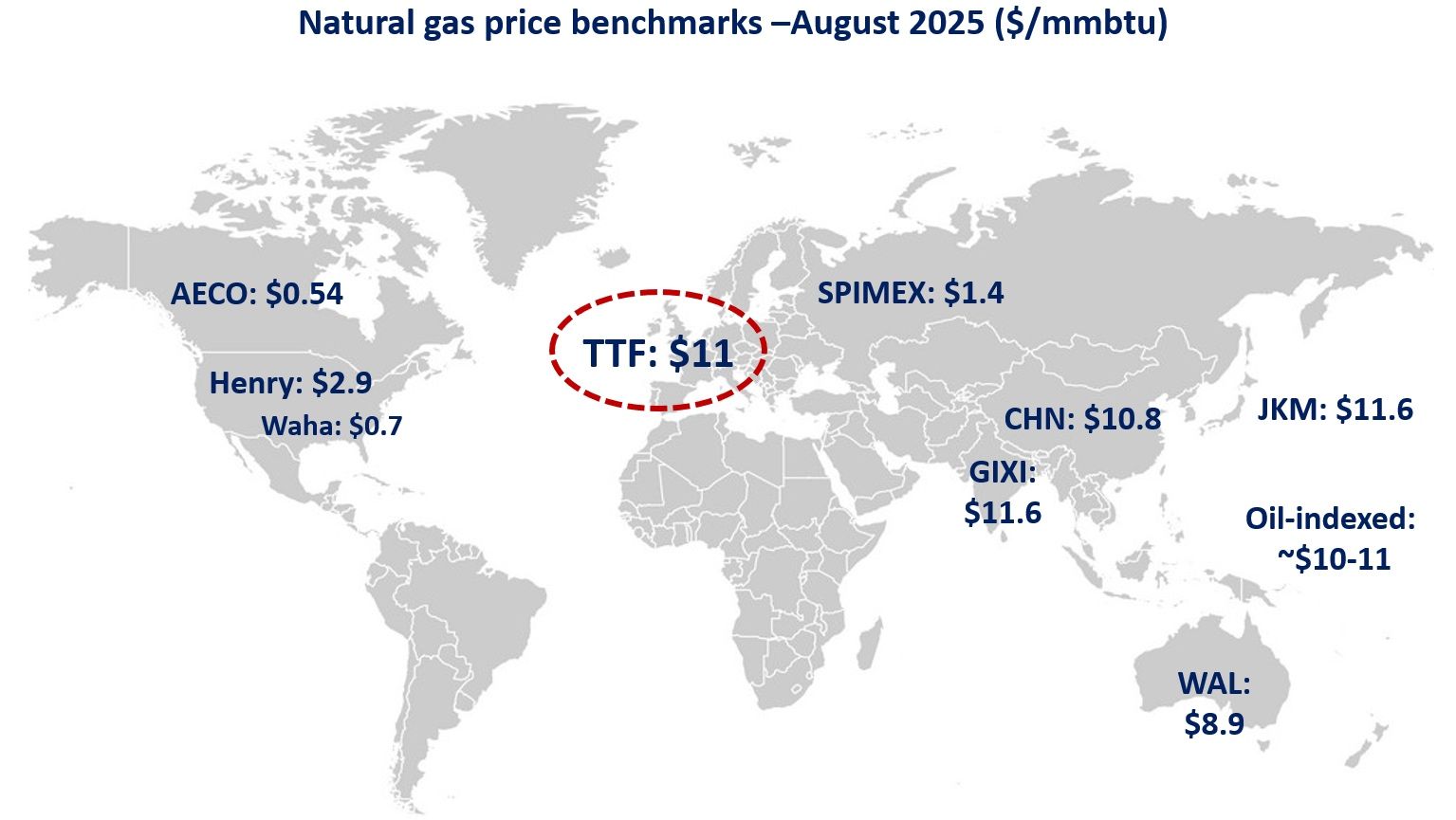

This is more than the expected increase in global LNG supply over this period, indicating that the summer market could be rather tight, with a strong competition for every drop of LNG.

The ramp-up of new LNG projects, such as Plaquemines in Louisiana, will be be crucial for a safe and secure gas balance.

Strengthening the transatlantic LNG partnership will be crucial to ensure Europe’s gas supply security in the New Global Gas Market which emerged after 2022.

What is your view? How will the summer gas market play out? Will we see the European premium firming up? Do you see downside risks to current price levels or could we see another bull run after the injection season starts?

Source: Greg MOLNAR