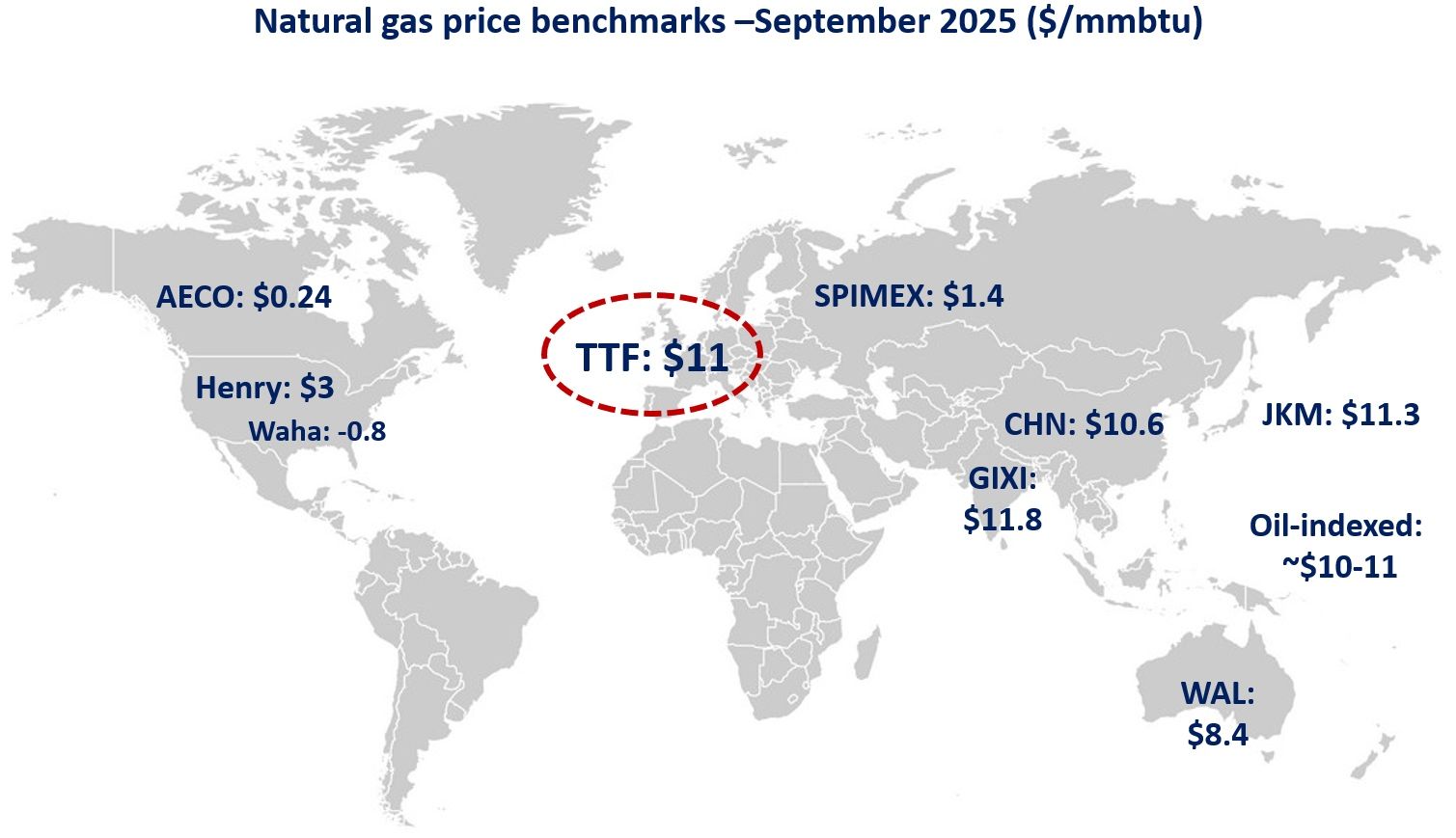

Asian and European gas prices continued to decline in September amid improving supply fundamentals and persisting demand weakness in key Asian markets.

In Europe, TTF prices dropped by 6% yoy to an average of $11/mmbtu. while colder weather boosted demand in the second half of the month, this was not sufficient to lift prices up.

A strong recovery in Norwegian piped gas deliveries, together with healthy LNG inflows put downward pressure on gas prices. Storage fill levels are now approaching 85% of capacity -albeit remaining about 12 bcm below last year’s levels.

In Asia, JKM prices fell by 16% yoy to an average of $11.3/mmbtu. improving LNG availability and persisting demand weakness is weighing on regional gas prices.

China’s LNG imports plummeted by 20% yoy amid weaker demand, higher domestic production and the continued ramp-up of Russian piped gas deliveries via Power of Siberia.

China’s domestic gas prices continue to trade well-below JKM prices, reducing the incentive to procure spot LNG.

In North America hub prices faced divergent dynamics. in Canada, AECO prices collapsed to an average of $0.24/mmbtu -their lowest monthly average on record.

High storage levels together with strong production growth is pushing down prices to near 0 levels (and sometimes into negative territory).

In the US, Henry Hub prices rose by 30% yoy to an average of $3/mmbtu, supported by stronger storage injections, while domestic production continues to trend at an all-time high.

In contrast, Waha prices in the Permian collapsed into negative territory to average at just -$0.8/mmbtu.

Outages at the El Paso pipeline effectively reduced takeaway capacity, resulting in a heavy gas oversupply at the Waha hub.

What is your view? How will gas prices evolve through the heating season? Happy New Gas Year!

Source: Greg MOLNAR