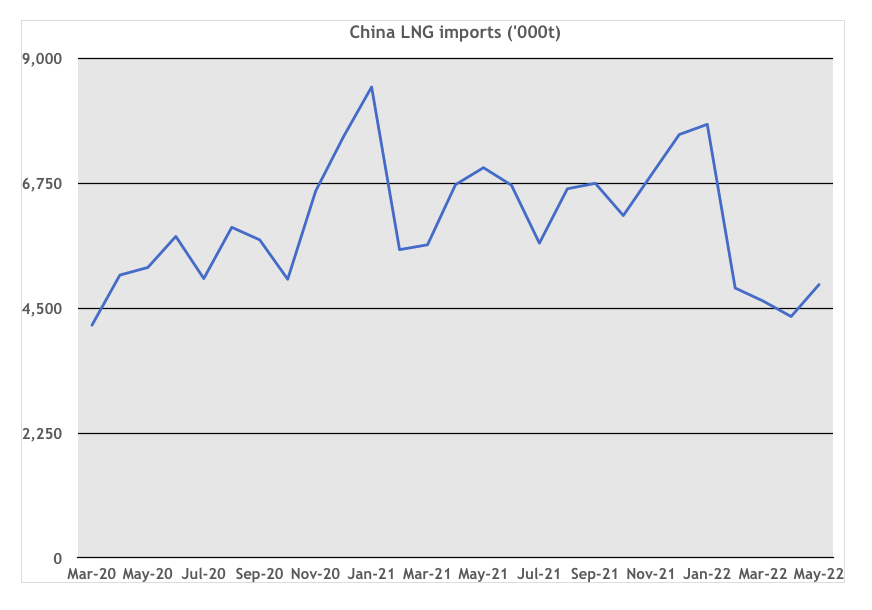

Squeezed between high winter demand, LNG plant outages and shipping congestion, northeast Asian LNG markets are facing the perfect storm these days.

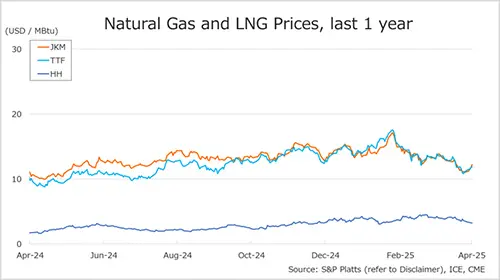

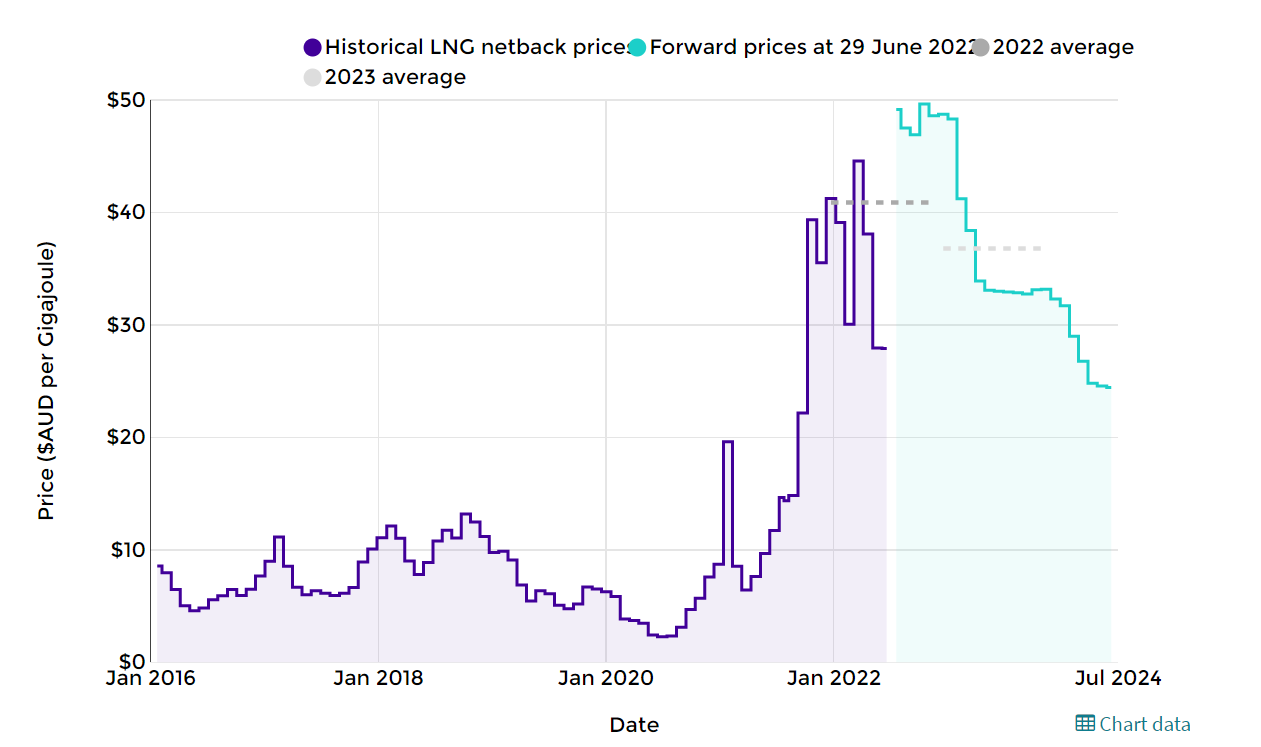

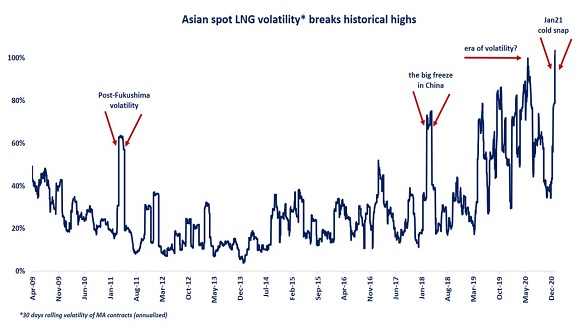

Asian spot prices are now trading well above $20/mmbtu (from just below $2/mmbtu in the summer), whilst some cargoes have been awarded at a record price of over $35/mmbtu, recalling the times of the post-Fukushima tightness.

The rapid tightening of the supply-demand fundamentals have translated not only to record-breaking prices but also to an extreme price volatility, primarily benefitting traders and portfolio players.

This highlights that despite the growing flexibility of the LNG market, its liquidity and short-term reactivity remains rather limited -especially when the availability of spot charters dries up.

What is your view? What lessons can we learn from the current market squeeze in northeast Asia? The structural rise in spot LNG volatility could be a driver for investment in short-term deliverability of the northeast Asian gas systems?

Source: Greg Molnar

See original post by Greg at LinkedIn.