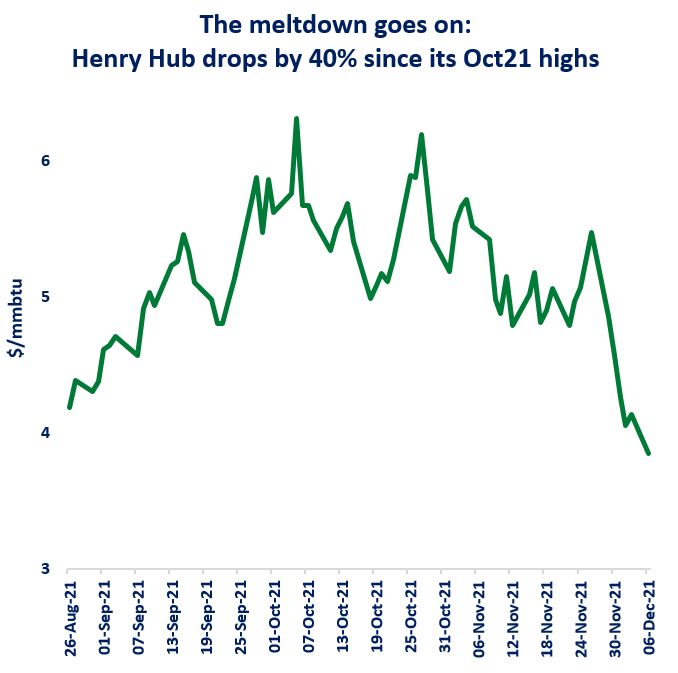

the meltdown goes on: Henry Hub prices fell by close to 40% since their October highs, trading today below $4/mmbtu, for the first time since late August.

several factors are contributing to the this strong price readjustment:

(1) US production has been increasing recently, up by 6% yoy through October-November, mainly driven by higher output from Appalachia. Gulf Coast production has also recovered since the Ida Hurricane shut-ins;

(2) storage levels look more comfortable: we are now just 2% below the 5year average vs 7% in September;

(3) mild weather conditions driving down residential and commercial demand, while Maxar is forecasting this December to be third warmest since 1950 based on gas-weighted heating degree days.

one point to note: LNG feedgas flows, often taken as a scapegoat for higher US prices, continued to increase while Henry Hub prices collapsed, reaching recently a record of 400 mcm/d.

what is your view? what will happen with Henry this winter? at the moment, it looks like a rapidly melting snowman… but colder winter temperatures should never ruled out, and they can be even fiercer in the second half of the winter…

Source: Greg Molnar (LinkedIn)