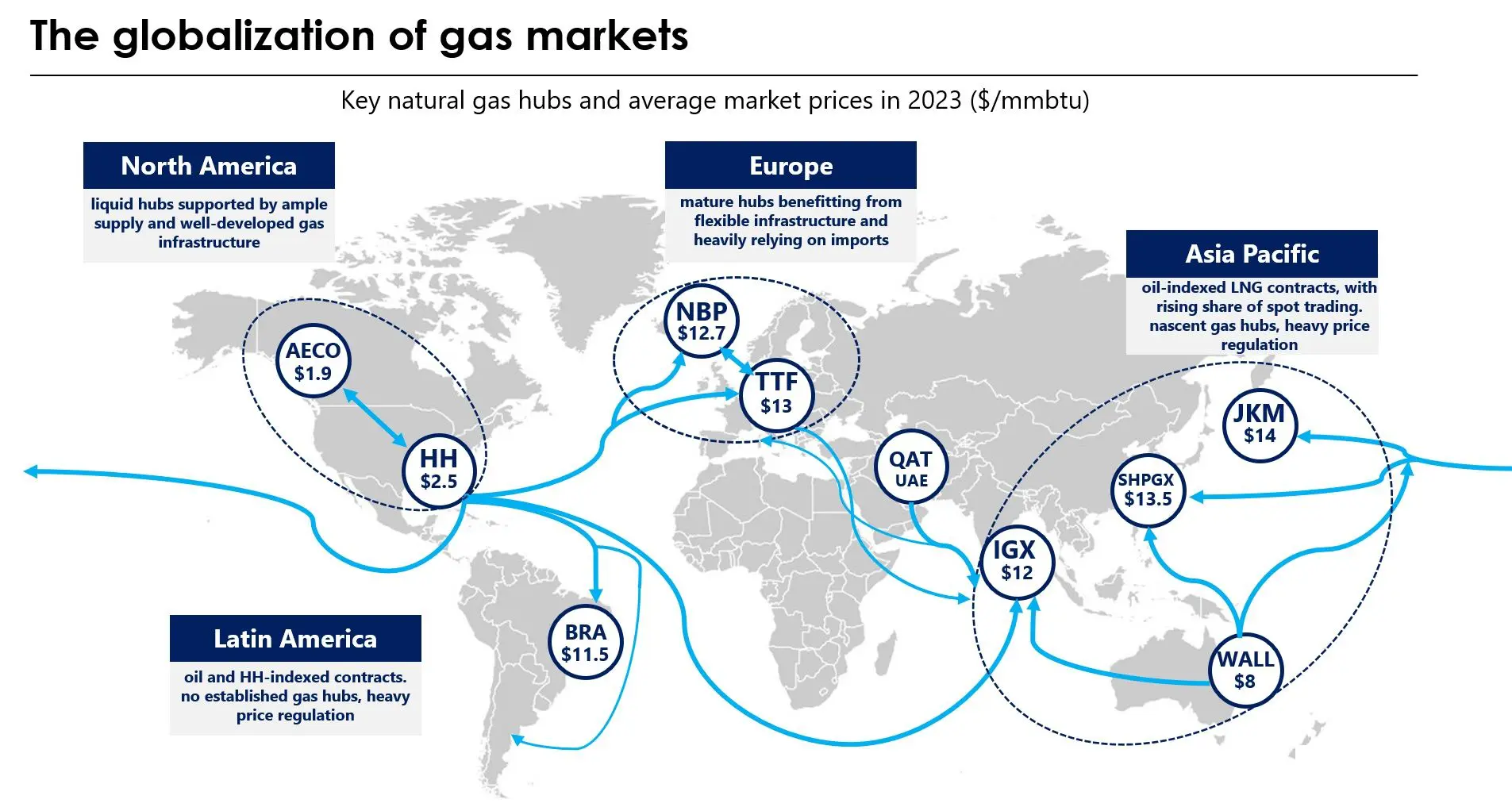

A major theme of this report (by EnergyQuest) is the federal government’s proposed takeover of the east coast gas market, throwing out the OECD gas market rule book with a move to cost-based pricing.

Just as the government was implementing its gas price cap, east coast prices were coming down anyway with the summer season surge in solar generation. The federal government interventions are covered in detail in this report.

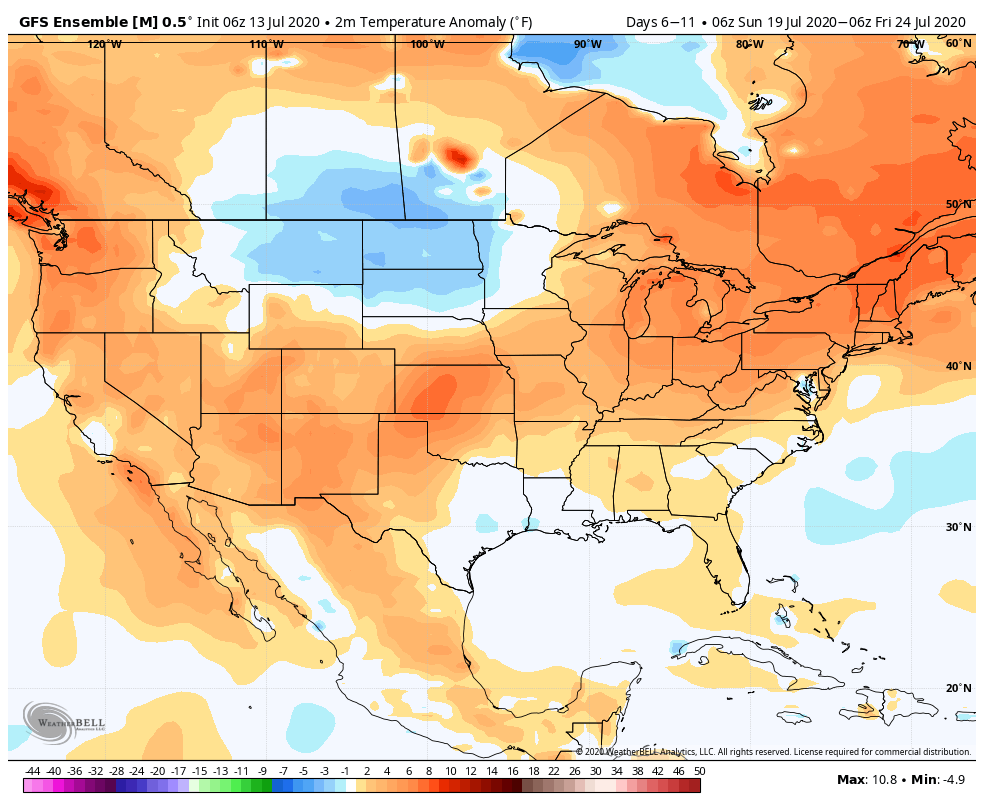

There are also increasing warnings about botched decarbonisation: fossil fuel generators closing more quickly than they can be replaced with renewables. Australia has also had its share of freak weather, namely the widespread flooding, which has affected east coast gas production and prices.

However, the good news on the east coast is the 121% 2P gas reserves replacement ratio in 2022. Reserves increased by more than production, in the Surat Basin by 635 PJ and in the Bowen Basin by 186 PJ. Despite the dire predictions, east coast conventional gas production reached a five-year high in 2022. There are certainly green shoots appearing but with the risk that they will be killed by the government intervention.

The report is not only about the east coast. Gas prices are rising in Western Australia and recent disruptions have raised concerns about gas supply security. At the same time, a drilling boom is underway in the Perth Basin, which is also experiencing an M&A boom.

LNG exports (some of which the government is threatening to block) earned Australia an eye-watering $91 billion in export revenue in 2022, despite lower Chinese LNG demand.

With the reforms proposed by the Albanese Government to the Safeguard Mechanism, Australia may finally get an emissions trading scheme. However, reaching net zero is a daunting task. The IMF estimates that a carbon price of $260 per tonne, not $75, would be needed for Australia to reach its 2030 emissions reduction target.

Other highlights include:

Source: EnergyQuest