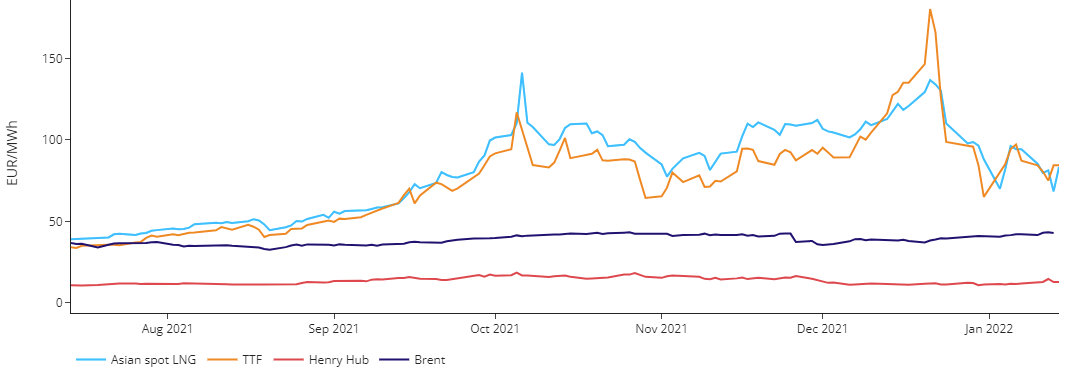

East coast gas prices moved over $10/GJ in March and have spiked in April, reaching $19.31/GJ in Brisbane on 9 April. This does not appear to be due to LNG exports but more likely due to closures and outages in coal-fired generation.

LNG demand in North Asia, Australia’s major market, turned down in February, dropping 17.7% below a year earlier. The trend continued in March, when Australian deliveries to China were down 15% from February. However, this was more than offset by additional cargoes to Korea and Japan.

Japan is looking to replace LNG imports from Russia and Australia could go a long way helping Japan to achieve this. This is according to the latest Australian LNG Monthly released by EnergyQuest

Some of the other highlights of the report are:

In March Australian projects shipped 6.41 million tonnes (Mt) (94 cargoes), the same as the 6.42 Mt (93 cargoes) in February.

EnergyQuest estimates that Australian LNG export revenue decreased slightly in March to $5.47 billion, down from $5.63 billion in February but up by 88% on March 2021.

Compared with February, Australian projects delivered 6 fewer cargoes to China and Thailand in March, but nine additional cargoes to Korea and Japan. There were no cargoes delivered to Europe.

In March, 22 cargoes were delivered to China after delivering 26 in February and 37 in March 2021.

West Coast shipments increased slightly to 4.6 Mt in March (4.5 Mt in February), with 66 cargoes in March compared to 64 in February.

Prelude FLNG shipped no cargoes in March but resumed production in April and had shipped one cargo by the middle of the month.

East coast LNG shipments decreased to 1.8 Mt in March (2.0 Mt in February), with 28 cargoes compared to 29 in February, and 31 cargoes of 2.1 Mt a year ago.

Notwithstanding high LNG spot prices there were only three spot cargoes reported for shipping from Australian projects in March.

Queensland imported gas from the other states in March, with flows in an easterly direction for the entirety of the month.

Queensland short-term domestic gas prices in March were higher averaging $10.75/GJ ($10.05/GJ in February) at Wallumbilla and $11.37/GJ ($10.14/GJ) in Brisbane. Southern short-term domestic gas prices in March were also higher compared to those in February, averaging $10.98/GJ ($9.83/GJ) in Sydney.

Power generation in March from coal fell to a record low for this time of year, with generation down by 342 GWh from a year earlier. The coal share of NEM generation fell to 62%, down from 66% a year earlier. Gas generation was up by 274 GWh from a year earlier.

Source : EnergyQuest