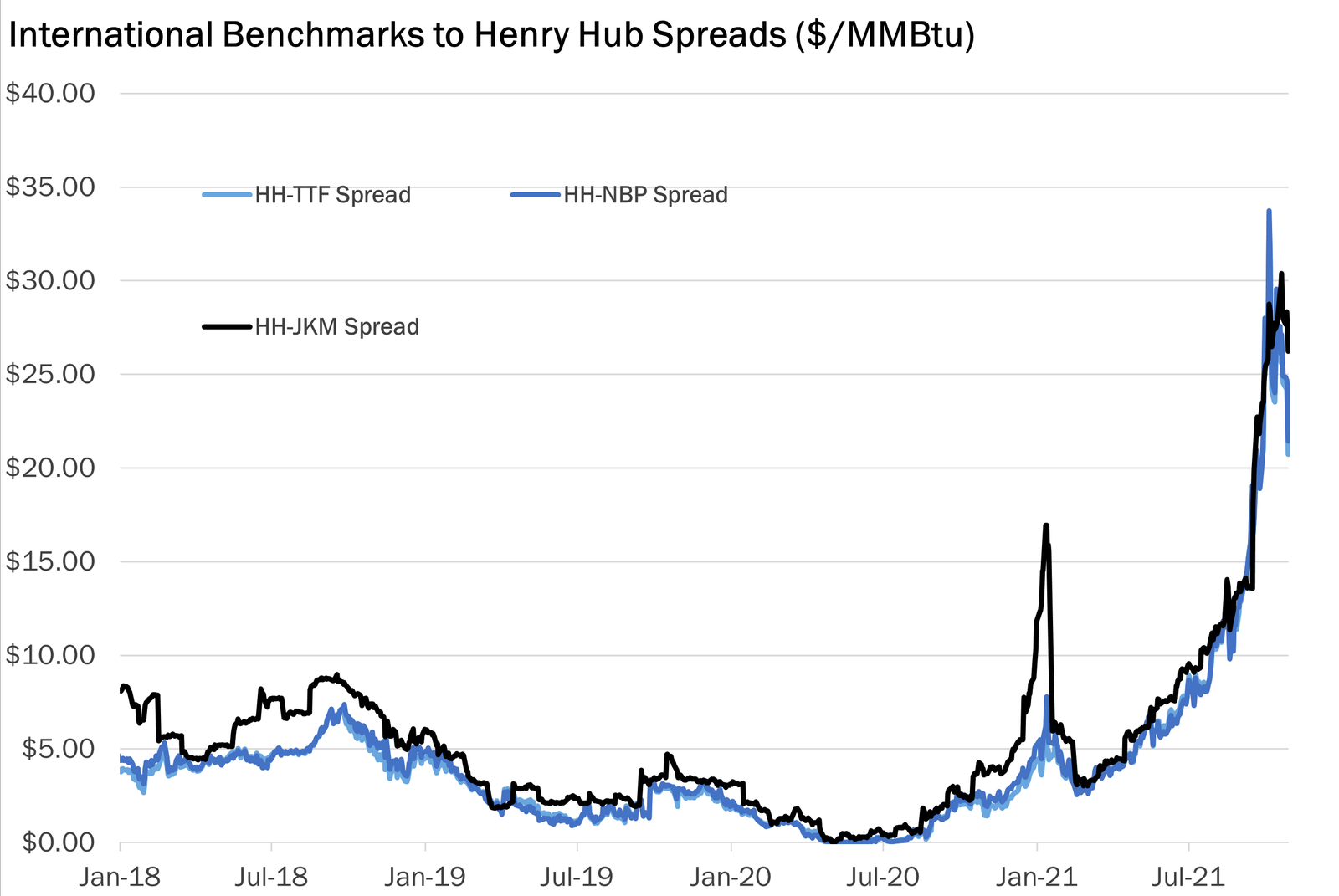

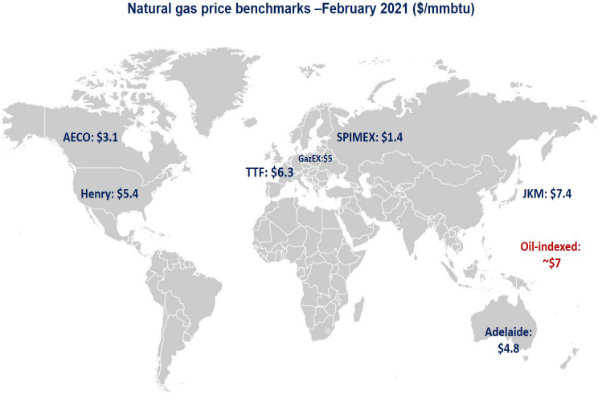

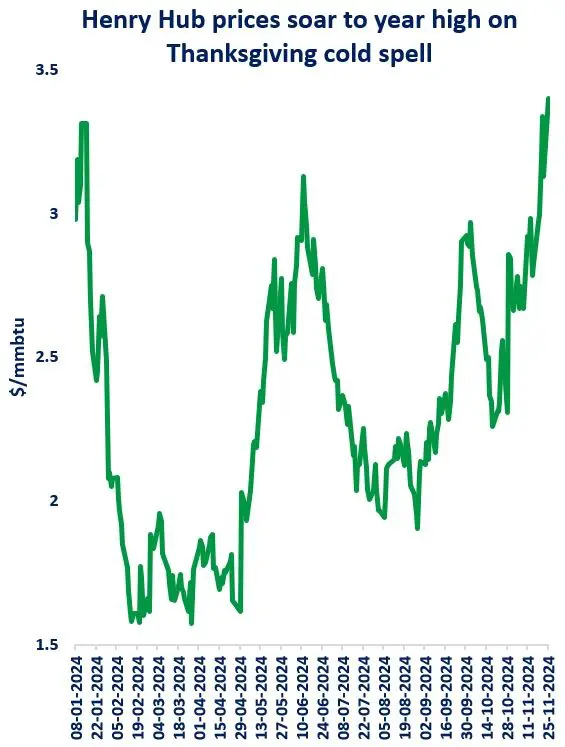

Henry Hub gas prices soared by more than 9% yesterday (November 25) to a year-high of $3.4/mmbtu, with Thanksgiving expected to bring winter storms and cold spells across the US.

Henry Hub month-ahead price surged by near 80% since August, reaching today their highest levels since November last year.

Four key factors have been contributing to this massive bull run:

(1) production cuts: US dry gas producers were reducing their output as a response to the price crash earlier in the year. US gas production dropped by 2% yoy since October;

(2) robust gas-fired power generation: gas burn in the power sector surged by 8% yoy in Nov, supported by stronger electricity demand and continued coal-to-gas switching;

(3) LNG feedgas flows are expected to ramp-up with the start-up of new LNG liquefaction facilities;

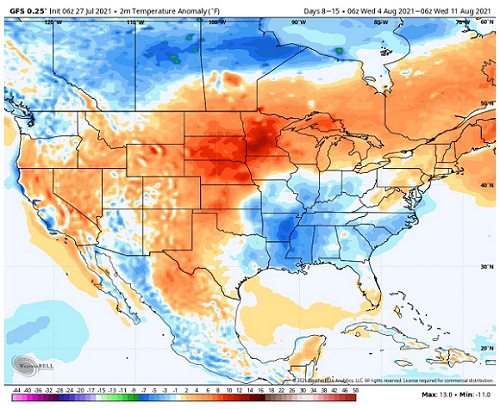

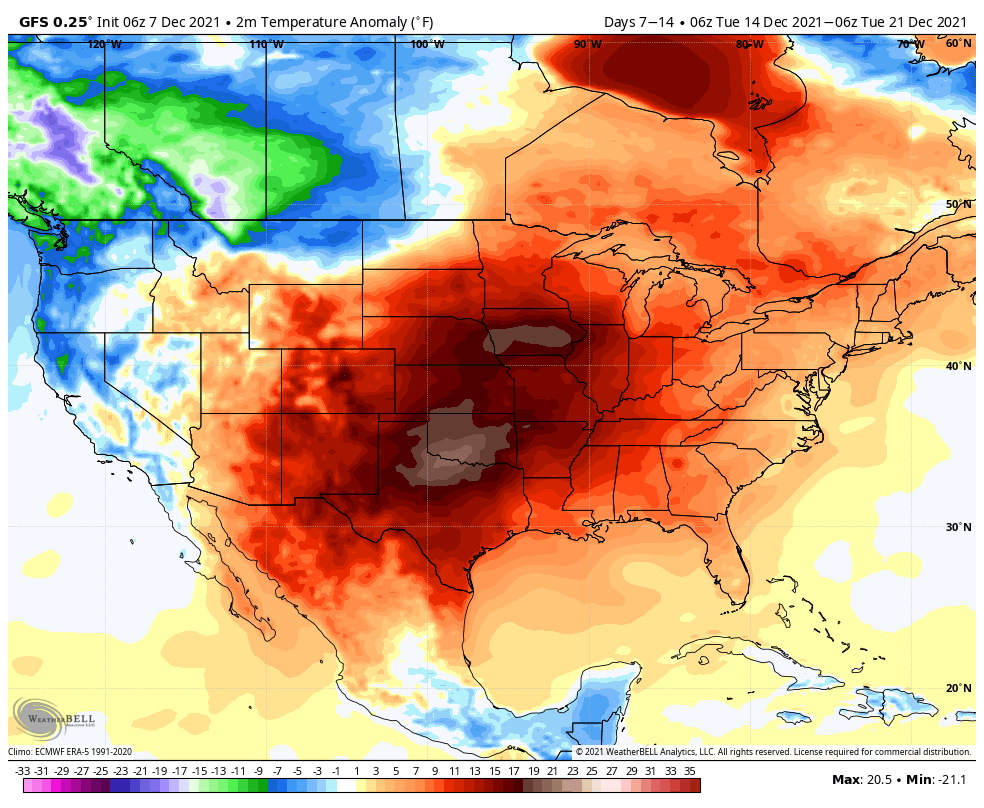

(4) early cold spell: Thanksgiving is expected to bring winter storms throughout the country, spicing up the already bullish fundamentals.

Meanwhile US storage sites turned to withdrawals, marking the official start of the heating season -although with inventory levels standing at their highest level in eight years.

What is your view? How will gas market dynamics evolve this winter in the US? More bull runs for Henry or it is time for the bears to get out?

Source: Greg Molnar