(Gelber) Fundamentally, the gas market is entering its strongest demand weeks since late March, which will be reflected in notably suppressed injection numbers.

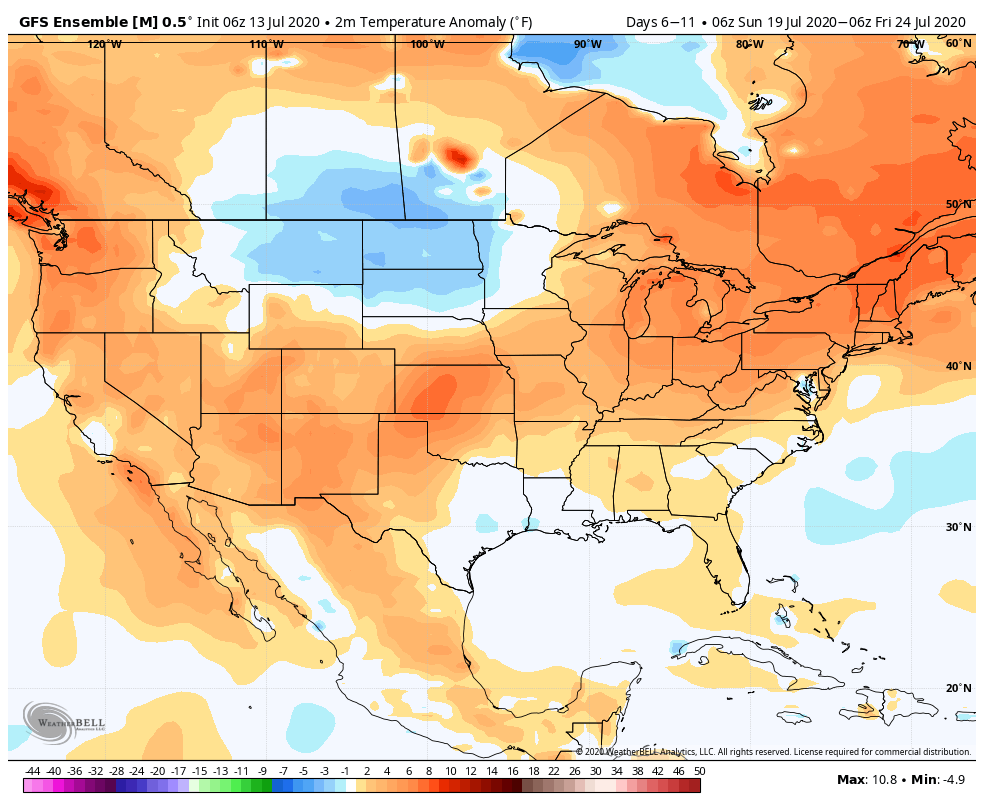

Although forecasts trended slightly cooler since Friday, temperatures remain substantially warmer than normal throughout the upcoming two-week period and are currently building toward a crescendo set for July 20th (see the 6-10 day forecast pictured below).

Aggressive fuel switching amid the hottest temperatures of the year are guaranteed to bring about additional natural gas power generation records in coming weeks.

However, after the early-month rally, the market is hooked on the current heat (and subsequent demand) maintaining itself without interruption going into August.

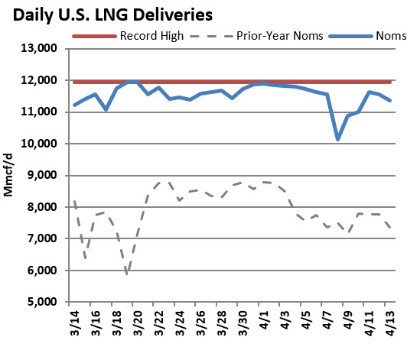

Meanwhile, LNG export utilization is hovering around 37% at the start of this week, while off-season industrial demand exhibits a 7-8% (~2 Bcf/d) shrinkage compared to last year.

Both sectors are providing persistent weakness at a time when other market indicators are trying to turn things around. On the supply side, there has been little action recently and volumes are hovering around 87 Bcf/d. Nonetheless, the market continues to keep a watchful eye on production for signs that previous months’ shut-ins are returning.

Source: Gelber

Connect with & follow Gelber on Twitter:

[tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]