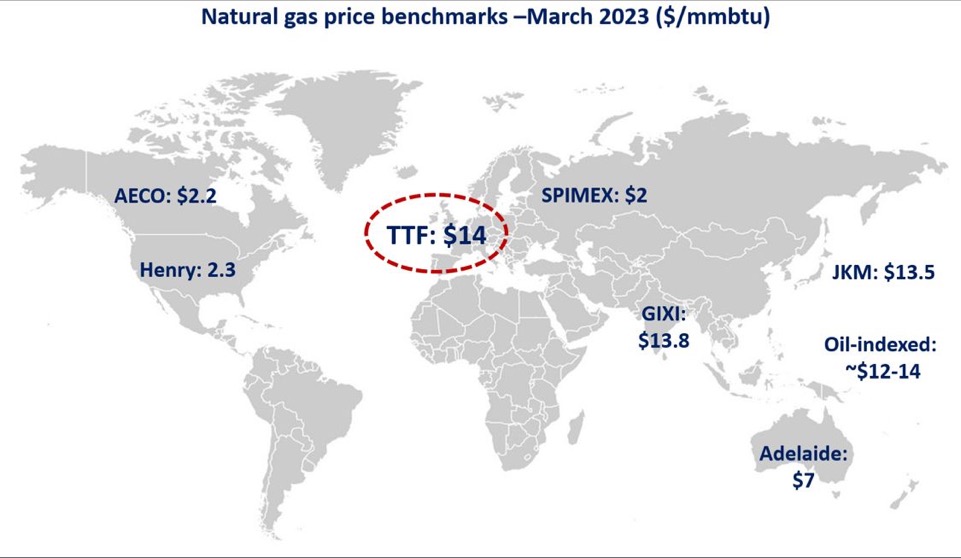

You can’t win the race: TTF rose by close to 2000% from its historical lows end of May 20, while Asian LNG spot prices surged by over 1000%.

This unprecedented bull ride is not driven by a single shock event (such as the Jan21 cold spell) but rather due to a combination of short-term supply-demand factors which tightened up both the European and the global gas market through several months.

What is quite interesting to see, is the extremely strong correlation between TTF and Asian LNG spot, as Europe and Asia are fiercely competing for LNG cargos. If we leave aside the Jan21 cold spell, the correlation between the two is over 0.97, comparable to the correlation we have been TTF and certain less liquid European hubs.

This highlights the emergence of a more closely interconnected global gas market due to the ever-growing share of spot LNG, flexible contracts and market players moving from a point-to-point logic to portfolio optimization.

And why you can’t win the race? With the current prices gas is becoming “unburnable”, we see this through gas-to-coal switching in and industrial plants closing in Europe, gas-to-oil switching in certain Asian markets and slow-down in China.

What is your view? How will the winter play out? Will the bull ride continue?

Source: Greg Molnar

See original post by Greg at LinkedIn.