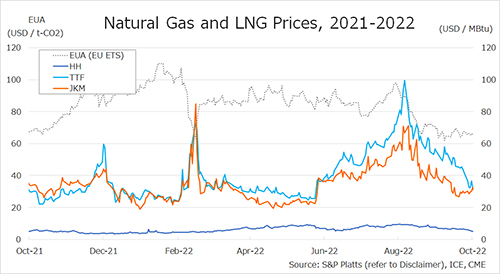

The Northeast Asian assessed spot LNG price JKM for the previous week (17-21 October) rose to USD 30/MBtu on 17 October from USD 29/MBtu the previous week, but fell to USD 29/MBtu on 18 October as demand for prompt cargoes declined.

On 20 October, the price rose to USD 30/MBtu due to buy bids from Japanese and Korean utilities and other factors, and continued to rise to USD 33/MBtu on 21 October.

According to a 19 October METI release, LNG inventories for power generation were 2.52 million tonnes as of 16 October, up 0.45 million tonnes from the end of the same month last year, and up 0.68 million tonnes from the average of the past five years, showing steady growth.

The European gas price TTF fall from USD 41.6/MBtu the previous week to USD 32.2/MBtu by 19 October due to a shortage of vessels and tight regasification capacity caused by an oversupply of LNG in Europe, as well as a decline in gas demand.

TTF rose on 20 October to USD 36.6/MBtu but dropped to USD 32.4/MBtu as discussion on EU energy price measures proceeded. On 17 October, Nigeria LNG declared FM.

Flooding in large areas of Nigeria disrupted gas production and shut down the gas supply to the LNG facility, but on 20 October the facility announced that it would continue LNG production with a limited gas supply.

The U.S. gas price HH fell from USD 6.5/MBtu the previous week to USD 5.0/MBtu by 21 October after dropping to USD 6.0/MBtu on 17 October, on weaker demand due to mild weather and a bullish gas production outlook.

Meanwhile, according to the EIA Weekly Natural Gas Storage Report released on 20 October, natural gas underground storage on 14 October totaled 3,342 Bcf, up 111 Bcf from the previous week, but still low, down 3.1% from the same period last year and down 5.2% from the five-year historical average.

Updated 24 October 2022

Source: JOGMEC