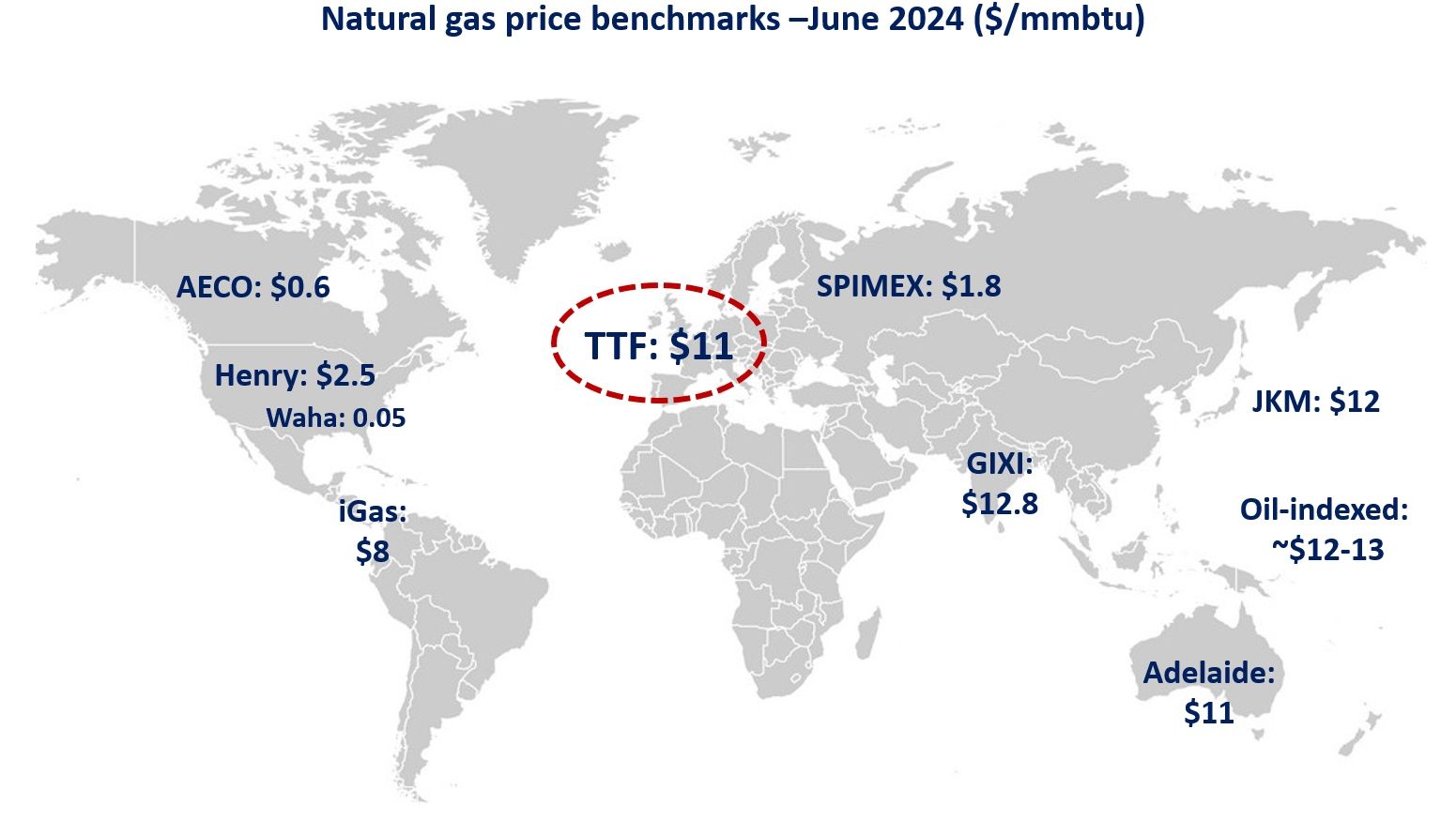

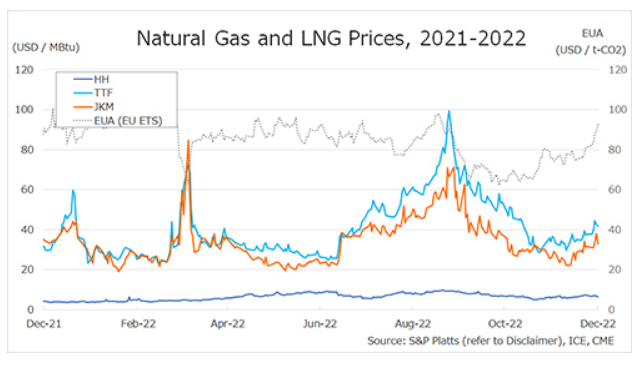

The Northeast Asian assessed spot LNG price JKM for the previous week (28 November-2 December) fell to USD 31/MBtu on 28 November due to weak spot demand in Asian countries, amid high LNG inventories and mild weather, from USD 32/MBtu the previous week.

The price rose for three consecutive days and hit USD 38/MBtu on 1 December, supported by higher European gas prices and cold weather in the North Asian region, which is expected to increase gas consumption as tank tops in China and Korea are eliminated and uncertainty over the discussion on the proposal to limit excessive gas price spikes.

On 2 December, JKM fell sharply to USD 33/MBtu due to low spot cargo liquidity and weak buying interest from Japan, China, and Korea.

According to METI, Japan’s LNG inventories for power generation were 2.53 million tonnes as of 27 November, down 0.08 million tonnes from the previous week, up 0.37 million tonnes from the end of the same month last year, and up 0.58 million tonnes from the average of the past five years, which remains a high level.

The European gas price TTF rose for the third consecutive day to USD 44.5/MBtu from USD 37.6/MBtu the previous week on the back of higher demand due to colder weather in Europe and below-average wind power generation in the UK.

The price then fell back to USD 42.7/MBtu on 1 December and to USD 41.9/MBtu the next day. In Europe, slot utilization rates at regasification facilities are increasing as demand for as prompt cargoes increases.

According to AGSI+, underground gas storage in Europe peaked at 95.62% on 13 November and began to decline, reaching 91.86% as of 2 December.

The U.S. gas price HH fell to USD 6.7/MBtu on 28 November from USD 7.0/MBtu the previous week. It then rose to USD 7.2/MBtu on 29 November, but fell for three consecutive days to USD 6.3/MBtu on 2 December.

According to the EIA Weekly Natural Gas Storage Report released on 1 December, natural gas underground storage on 25 November was 3,483 Bcf, down 81 Bcf from the previous week, down 2.5% from the same period last year, and down 2.4% from the historical five-year average.

Updated 5 December 2022

Source: JOGMEC