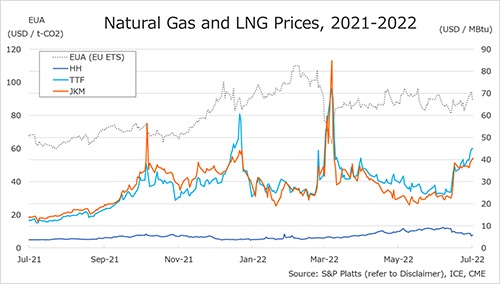

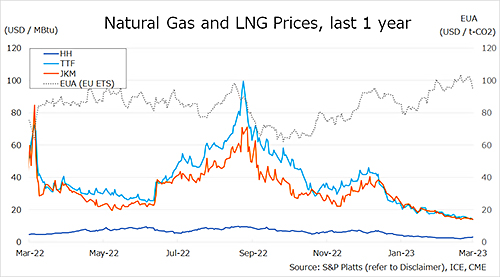

Global gas prices strengthened sharply last week, led by strong gains in Europe and the United States as colder weather, falling storage levels and supply disruptions tightened near-term fundamentals, while Asian LNG prices followed at a more moderate pace.

The Northeast Asian spot LNG benchmark JKM (March delivery) rose into the low-USD 11s/MMBtu by 23 January, up from the low-USD 10s/MMBtu the previous week. Spot activity remained limited, but prices were supported by strength in European gas markets and a cold spell across Northeast Asia, which lifted sentiment. Japanese LNG inventories for power generation edged slightly higher week-on-week, indicating that supply remained adequate despite firmer prices.

European gas prices surged, with TTF (February delivery) rising to USD 13.8/MMBtu by 23 January, the highest level since June last year. Early-week weakness driven by warmer weather forecasts reversed sharply as falling storage levels, unplanned outages at Norwegian production facilities, heightened Europe–US tensions and associated hedge fund activity triggered a strong rally. EU-wide gas storage fell to 46.2%, well below both last year’s level and the five-year average, reinforcing market sensitivity to cold weather and supply risks.

US Henry Hub prices climbed sharply, rising to USD 5.3/MMBtu by 23 January from USD 3.1/MMBtu the previous week. The rally was driven by increased heating demand during a severe cold spell, concerns over freeze-offs affecting production and pipelines, and heightened speculative buying. US gas inventories declined by 120 Bcf week-on-week but remained above both last year’s level and the five-year average.

Updated 26 January 2026

Source: JOGMEC