The last three months have significantly added to the current state of uncertainty. Many previously held assumptions continue to be challenged: supply is growing at a pace well above what would have been expected based on established rationales and all aspects of the market are made increasingly volatile by the influence of geopolitics.

The result is that the pace of change for the long-term outlook is accelerating and it is becoming more difficult to narrow down the range of possible long-term scenarios.

Here are some of the key highlights of the last quarter:

Three projects took FID for a total of 33.4 mtpa; when accounting for the fact that over the last three months Arctic LNG 2 restarted delivering volumes and Mozambique LNG 2 also has appears increasingly close to restarting construction, the addition in supply could reach 59.2 mtpa

A total of 41 long-term contracts were signed, more than the two previous quarters combined. This includes 19.70 mtpa of binding commitments from pre-FID projects and a few more of these appear likely to take FID in the next 12 months – in short, the wave of new supply still has room to grow to an even larger magnitude

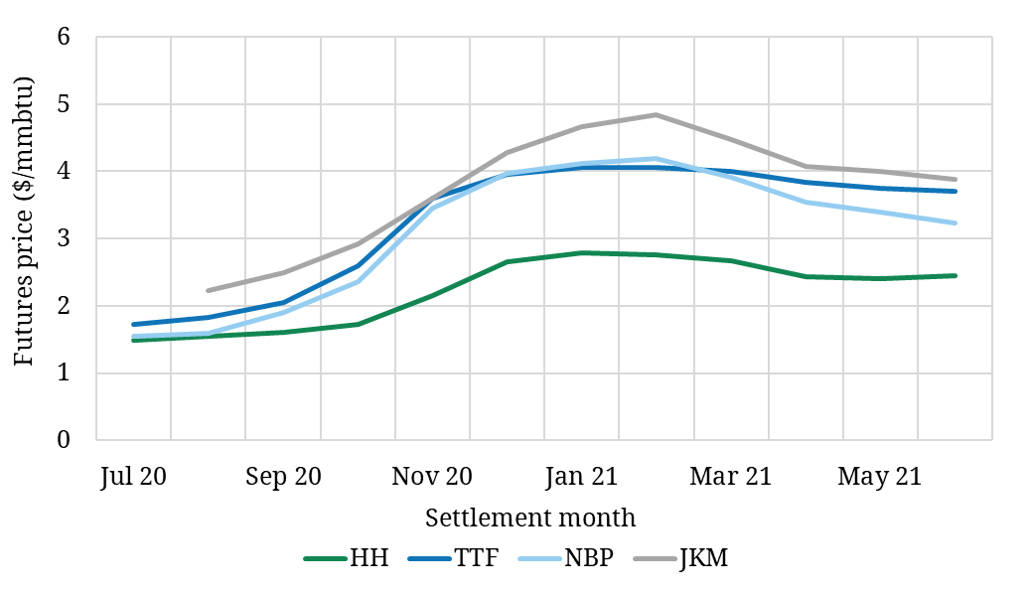

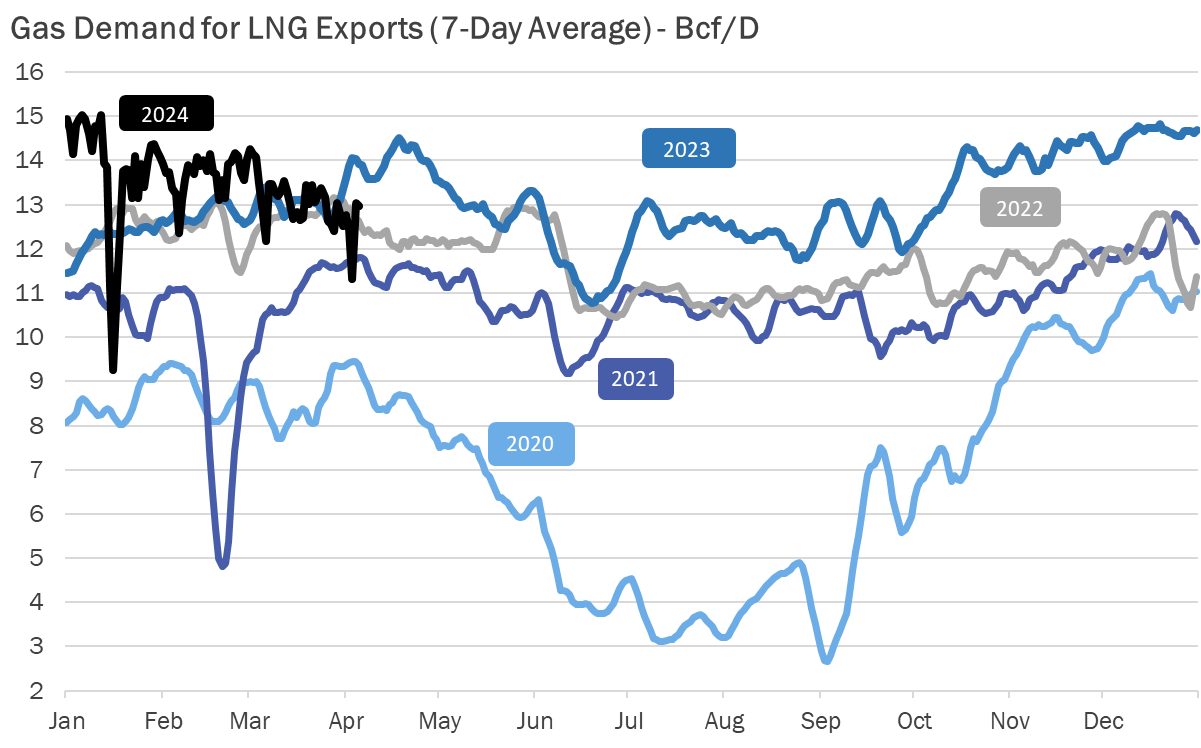

The magnitude of supply being added to the market means that, as a result of the events of this quarter, I now assess at least one instance of US shutdowns during the summer in the period to 2030 as being the most likely scenario

Increased contracting activity was led by two main drivers: a renewed push for growth by emerging US offtakers to continue growing their portfolios and an increased politicization of LNG flows

The result of these two drivers global is that portfolio length has continued to grow significantly over the last three months, increasing the expected competition for demand sinks in the coming years

A stronger politicization of LNG trade also means an increasing focus on security of supply. India and China may be opportunistic buyers as long as spot LNG is abundant and cheap, but their willingness to become locked into a long-term exposure to large volumes of LNG imports may prove less strong if those imports are intrinsically tied to broader geopolitical risks, as hinted at in recent months

The expectations for the decline in demand from established markets are also changing: an aggressive phasing out of natural gas appears to be less politically attractive, and such a scenario is being taken less seriously by market participants than it was in previous years – an extended period of low gas prices may also materially impact the economic attractiveness of alternatives to natural gas and further dent many governments’ commitment towards the most aggressive decarbonisation targets.

Source: Giovanni BETTINELLI