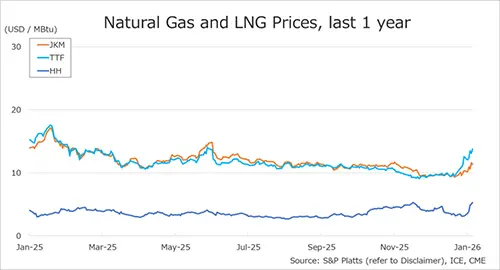

NEW CHART: Global Natgas Spreads (adjusted for U.S. LNG Exports) – updated daily on http://bluegoldtrader.com

The spread is the simple arithmetic difference between global natural gas prices and U.S. Henry Hub price + liquefaction cost + liquefaction fee (tolling model).

For example, when NBP-HH spread is positive – it means that it is profitable to export U.S. LNG to the UK (subject to additional transportation expenses).

When Asia-Europe spread is positive, it means that it is more profitable (or less costly) to export U.S. LNG to Asia (rather than to Europe). When Asia-Europe spread is negative, it means that it is more profitable (or less costly) to export LNG to Europe (rather than to Asia).

Source: Bluegold Trader