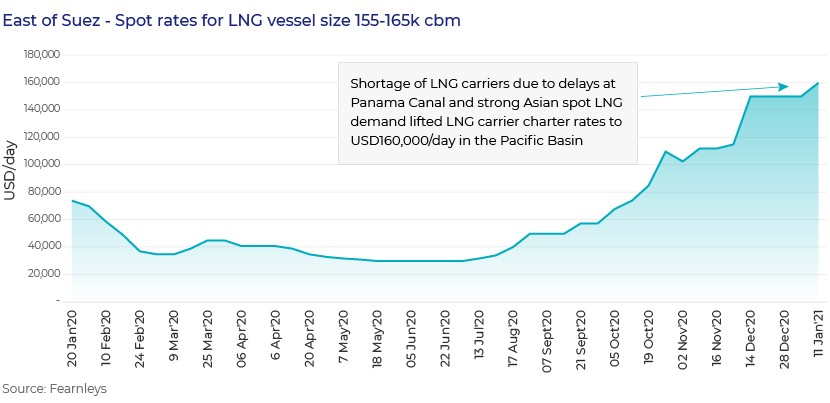

Spot charter rates for TFDE carriers reached an unprecedented USD 350,000/day in the second week of January 2021 due to a shortage of LNG carriers.

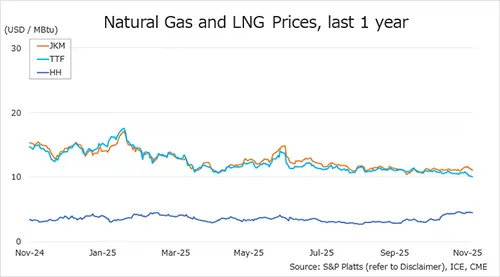

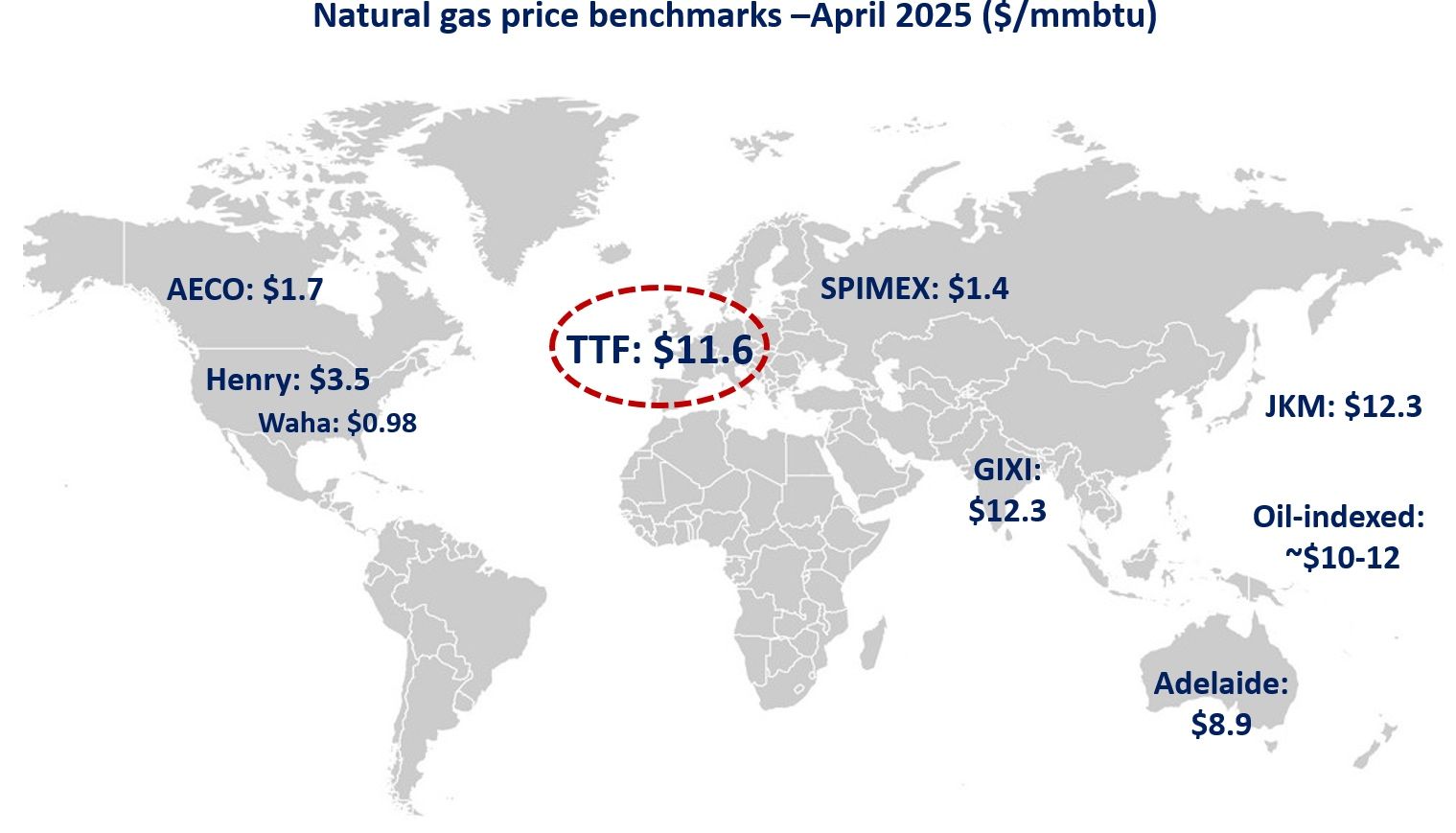

High Asian spot LNG prices of around USD 30/MMBTU created a wide price spread of USD 23/MMBTU between UK NBP and JKM prices (the Atlantic and Asian LNG price benchmark) and attracted Atlantic Basin volumes.

The longer voyage time associated with the Atlantic-to-Pacific trade (resulting in higher tonne-mile demand), along with delays at Panama Canal and temporary supply disruptions at Pacific export facilities such as the Gorgon LNG facility, Bintulu LNG terminal and many others, has left Pacific LNG buyers dependent on Atlantic LNG, creating a shortage of LNG carriers in the Pacific Basin.

I expect LNG charter rates to start weakening slightly from the end of January 2021, for the following reasons:

About one-fourth of new-build LNG carrier deliveries for 2020 was moved to 2021, increasing the number of LNG carriers in the market.

In addition, with the increase in LNG supply in the Pacific Basin and the expected slowdown in the Asian LNG price rally, the movement of LNG carriers from the Atlantic Basin to the Pacific Basin will likely start to slow, reducing the tonne-mile demand of LNG carriers and increasing vessel availability.

However, the delays at Panama Canal, which are likely to extend until March 2021, should support charter rates and prevent a major correction.

Source: Shefali Shokeen

Connect with Shefali on LinkedIn