Cheniere & CME Group are developing a physically settled LNG futures contract, delivering at Sabine Pass. This will add to existing SGX & ICE LNG futures contracts and some bilaterally traded derivatives. Liquidity is embryonic but starting to grow.

4 factors driving growth:

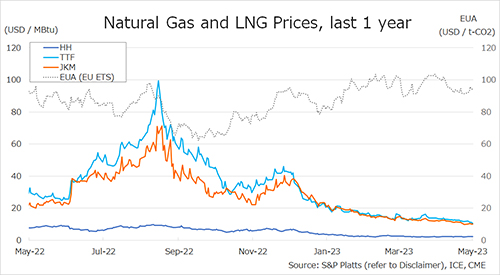

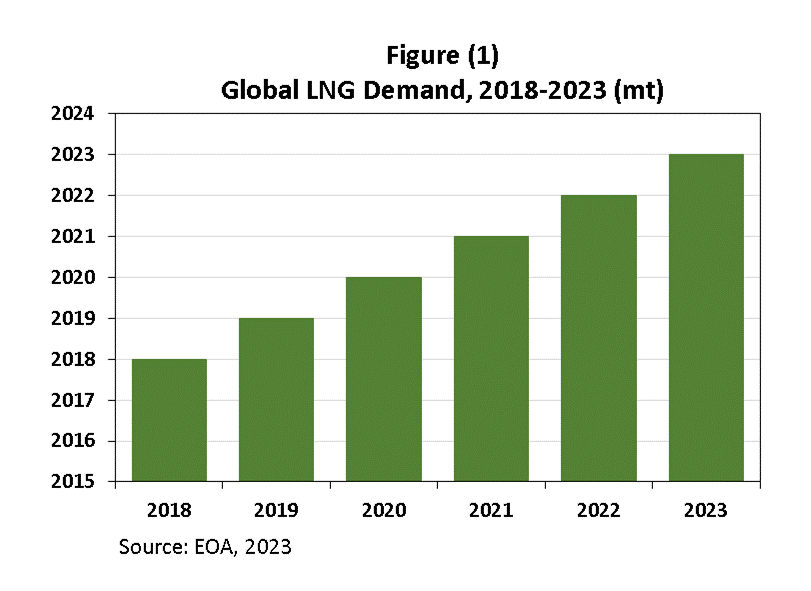

Spot liquidity: Derivatives require a liquid spot reference price. This is being facilitated by growth in spot cargo trade and maturing price markers.

Increasing flexibility: LNG portfolios are becoming more complex and flexible. E.g. US export contracts are rapidly boosting shorter term trading & optimisation of LNG supply.

Asian buyers: Structural imbalances & new supply in Asian LNG portfolios are seeing buyers expand commercial & risk management capabilities to support portfolio management.

Commodity traders: Intermediaries such as Vitol, Trafigura & Gunvor are rapidly expanding their LNG market presence. Their focus on shorter term arbitrage opportunities & risk management requirements are a catalyst for liquidity.

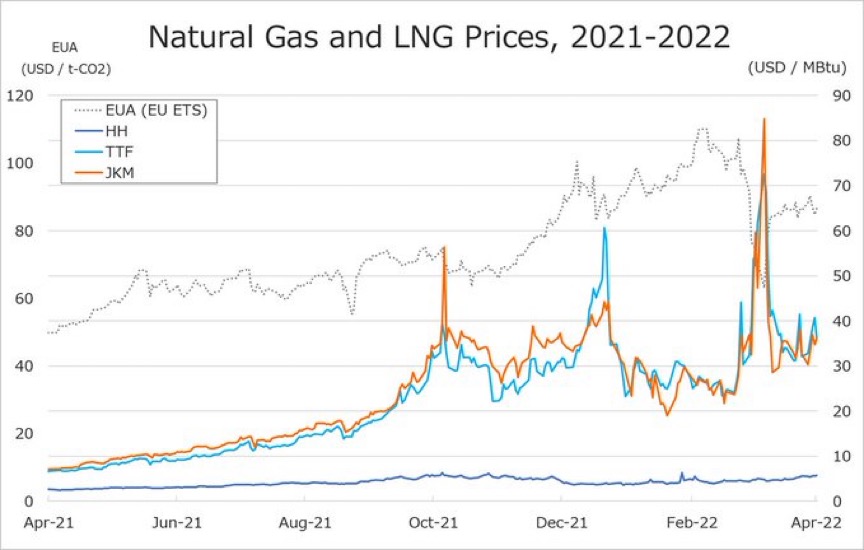

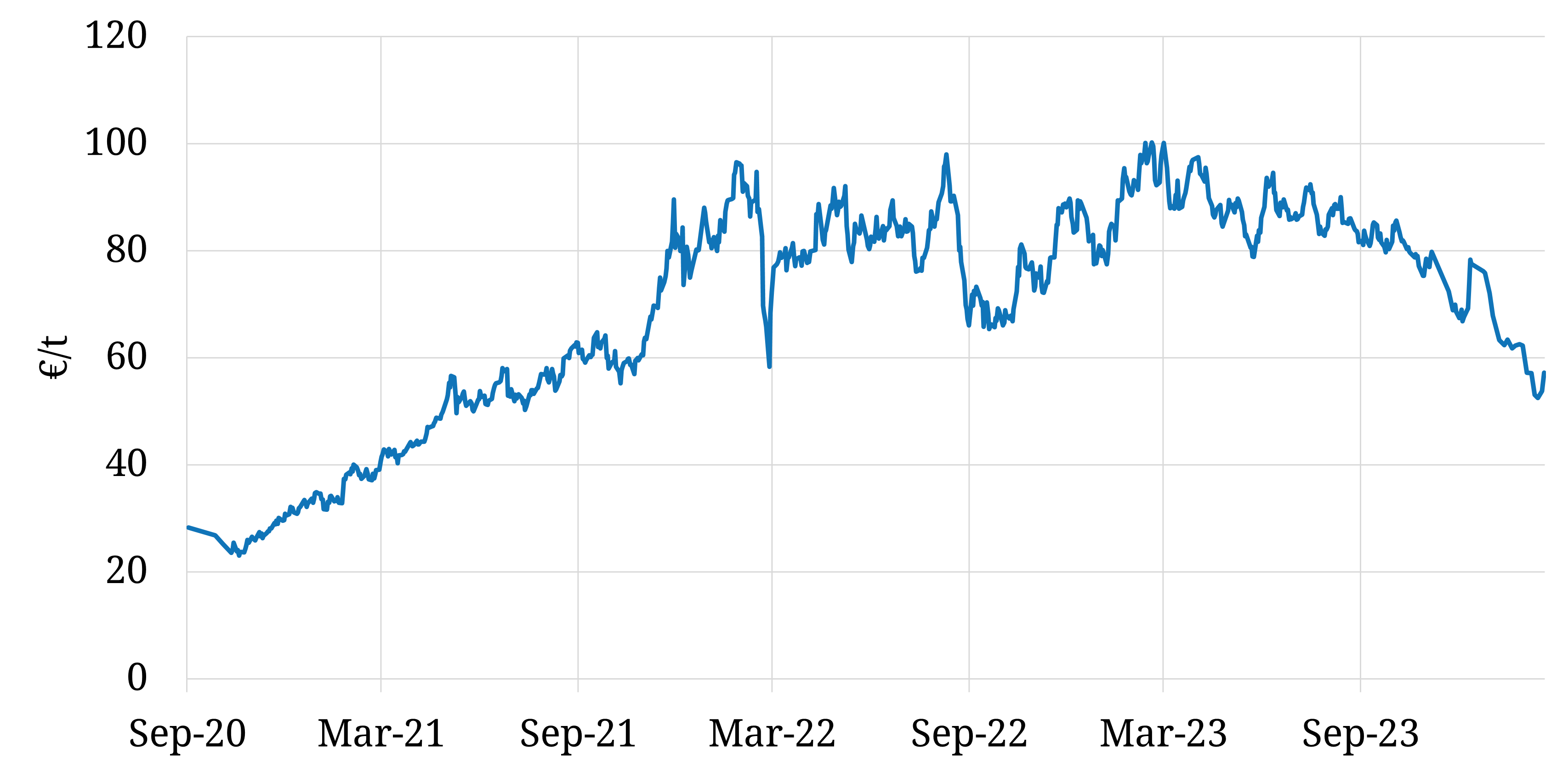

The majority of LNG portfolio hedging will continue to be done at key liquid hubs (TTF, NBP, HH). But growth in derivatives will facilitate greater flex to realise value from regional spot price liquidity & volatility.

Source: Timera Energy