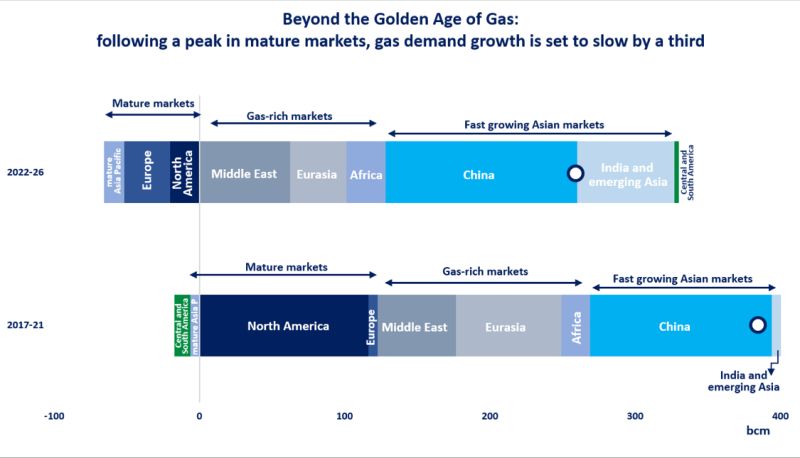

Following its peak in mature markets, gas demand growth is set to slow by almost a third in 2022-26 compared to the previous 5 years, when gas demand was the fastest growing source of energy supply.

The combined demand of Europe, mature Asia Pacific and North America peaked in 2021 and is set to decline by 1% per year over the medium-term.

The gas supply shock triggered by Russia reinforced the structural drivers accelerating gas demand reductions in Europe and the mature markets of the Asia Pacific.

In North America, the continued deployment of renewables and efficiency gains are set to drive down gas consumption. Overall demand is set to drop by over 60 bcm in those markets.

This is a key change compared to the previous 5 years, when mature markets accounted for 30% of demand growth, primarily driven by the coal-to-gas switching dynamics in the US power sector.

Over the medium-term, demand growth is increasingly concentrated in the gas-rich countries of Africa and the Middle East, as well as the rapidly growing import markets of the Asia Pacific region.

China alone accounts for almost half of global demand growth.

The strong additions of LNG supply towards the end of the forecast period is set to ease market fundamentals and could unlock price sensitive demand across Asian import markets. However, this will largely depend on the pace of clean energy technology deployments.

What is your view? How will gas markets evolve in the coming years? Will Asia able to carry on as the main engine behind demand growth? What is next beyond the Golden Age of Gas?

Source: Greg Molnar (LinkedIn)