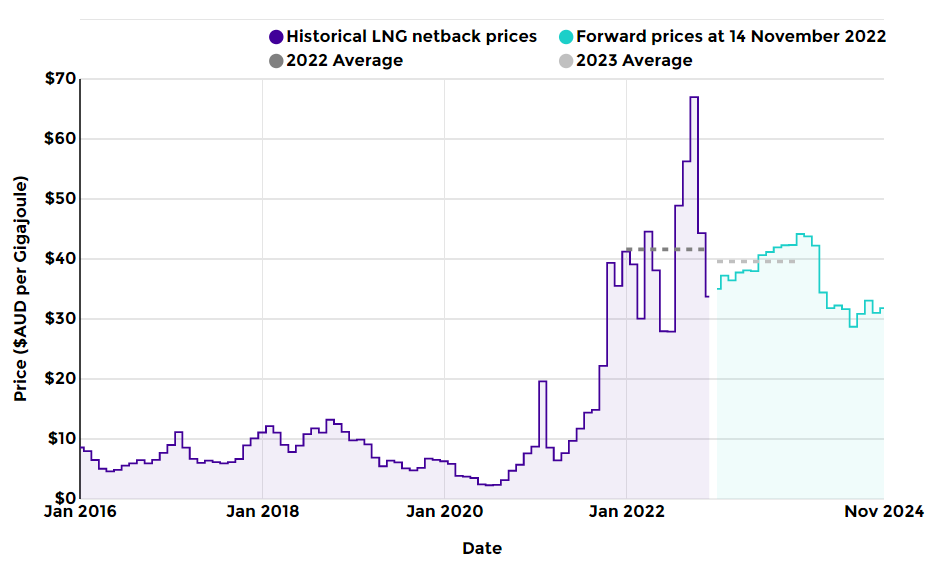

European benchmark prices remain at ~$28/MMBtu – a far cry from the $60 prices observed two weeks ago, but also an equal distance away from the sub-$4 pricing noted nearly one and a half years ago in the first, initial COVID wave.

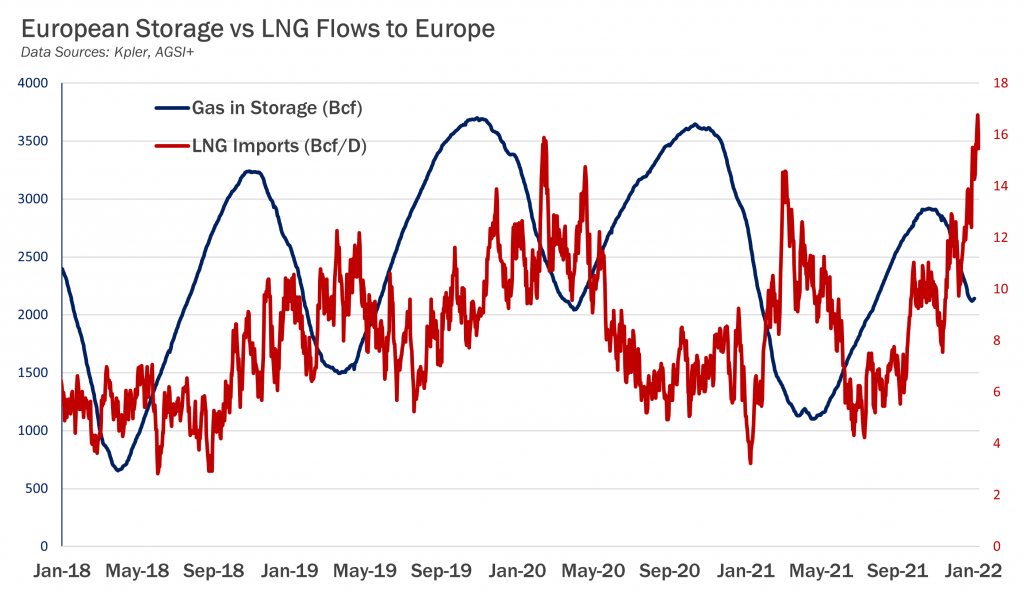

The graph displays European storage over the past three years against LNG inflows into Europe.

The latest storage peak is far below that of previous years, highlighting the severity of the current crisis. However, mild weather in combination with what is shaping up to be the highest number of European LNG imports historically is doing much to prevent prices from rising to their previous levels.

As a result, the rate of decline for European storage has slightly dropped off and as warmer temperature anomalies consolidate in Northern Europe, storage will have to do its utmost to take advantage of the temporary reprieve handed to it by weather. Early forecasts for Week 2 reveal the potential for wide-sweeping colder than average temperatures.

As a result, withdrawals are expected to appear in larger numerical quantities, and even the large influx of LNG deliveries may be rendered useless if European temperatures continue to trend towards the cooler side in upcoming forecasts.

The winter is by no means over, and as European benchmarks languish near the $30 range, European prices still display considerable upside risk, and the possibility that prices once again soar to the $60 range is not inconceivable.

source: Gelber and Associates