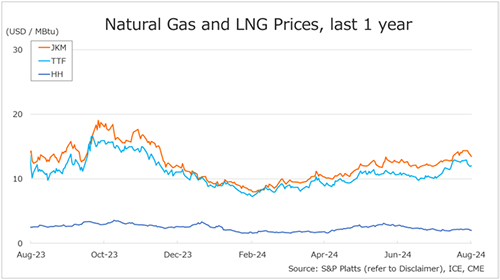

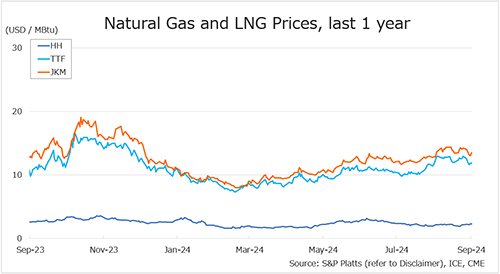

The Northeast Asian assessed spot LNG price JKM (October delivery) for last week (2 – 6 September) fell to mid-USD 13s on 6 September from low-USD 14s the previous weekend (30 August).

The price fell for four consecutive days from the beginning of the week due to weak demand against a backdrop of continued high prices, reaching the low-USD 13s on 5 September, but returned to the mid-USD 13s on 6 September due to increased buying interest from price-sensitive countries on the back of daily price declines.

METI announced on 4 September that Japan’s LNG inventories for power generation as of 1 September stood at 1.83 million tonnes, down 0.23 million tonnes from the previous week.

The European gas price TTF (October delivery) for last week (2 – 6 September) fell to USD 11.9/MBtu on 6 September from USD 12.9/MBtu the previous weekend (30 August).

TTF fell to USD 11.6/MBtu on 4 September as major maintenance in Norway was factored in and geopolitical risks did not increase, but rose slightly later in the week on forecasts of major additional cargo procurement in Egypt and lower temperatures in Europe. According to AGSI+, the EU-wide underground gas storage increased to 92.8% as of 6 September from 92.2% the previous weekend.

The U.S. gas price HH (October delivery) for last week (2 – 6 September) rose to USD 2.3/MBtu on 6 September from USD 2.1/MBtu the previous weekend (30 August).

The EIA Weekly Natural Gas Storage Report released on 5 September showed U.S. natural gas inventories as of 30 August at 3,347 Bcf, up 13 Bcf from the previous week, up 6.6% from the same period last year, and 10.7% increase over the five-year average.

Updated: September 9

Source: JOGMEC