Natural gas futures had been trading upwards all week, rebounding after trading a ferocious fall since mid December of 2022 which saw prices as high as $6.87/MMBtu come down to as low as $1.96/MMBtu.

April’s contract was down more than 15 cents yesterday in early morning trading before slowly creeping back and ultimately turning positive to end the trading session up 3 cents. The question is whether or not today will be a similar story as NYMEX prompt month has fallen 6 cents to start this morning.

While US natural gas production has been hovering above 100 Bcf/D, nearly 4-5 Bcf/D higher than the same time last year, market participants have been looking for freezing Arctic temperatures this winter to help combat the strength producers have continued to show. ResComm demand has not materialized into the what was previously forecasted by many analysts pre-winter.

G&A has been touting temperatures that are going to be cooler than average start to March, which has helped natural gas futures rebound to $2.78/MMBtu.

This represents a 82 cent climb from the low in only five trading sessions, highlighting that the market is still in an incredibly volatile state. If the weather patterns continue to materialize, it is likely that March could bring in demand for natural gas that is the highest since early February.

While the market is certainly reacting to short-term colder than normal temperatures, a fundamental shift has not yet occurred which would give market bulls more significant scaffolding to build upon for a chance to make a run back above $4/MMBtu.

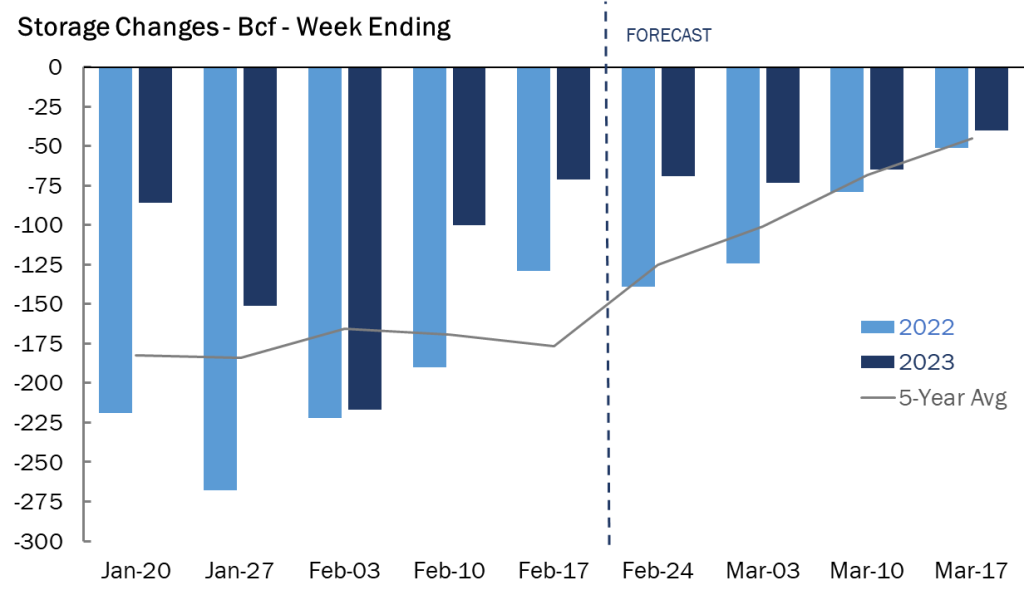

US natural gas storage sits at a whopping 395 Bcf higher than last year at this time and 289 Bcf above the 5-year average. G&A is currently forecasting a 69 Bcf withdrawal for the week ended February 24th.

To put this into perspective, the chart below shows the 5-year average withdrawal for the same week is 134 Bcf (gray line).

NYMEX April 2023 Contract Trades Near $2.73/MMBtu

Source: Gelber & Associates