NYMEX front-month natural gas futures closed at fresh 2022 highs during midweek trading as prices crested at $9.677/MMBtu on Wednesday as speculators added more long positions despite conflicting bearish fundamentals in the marketplace.

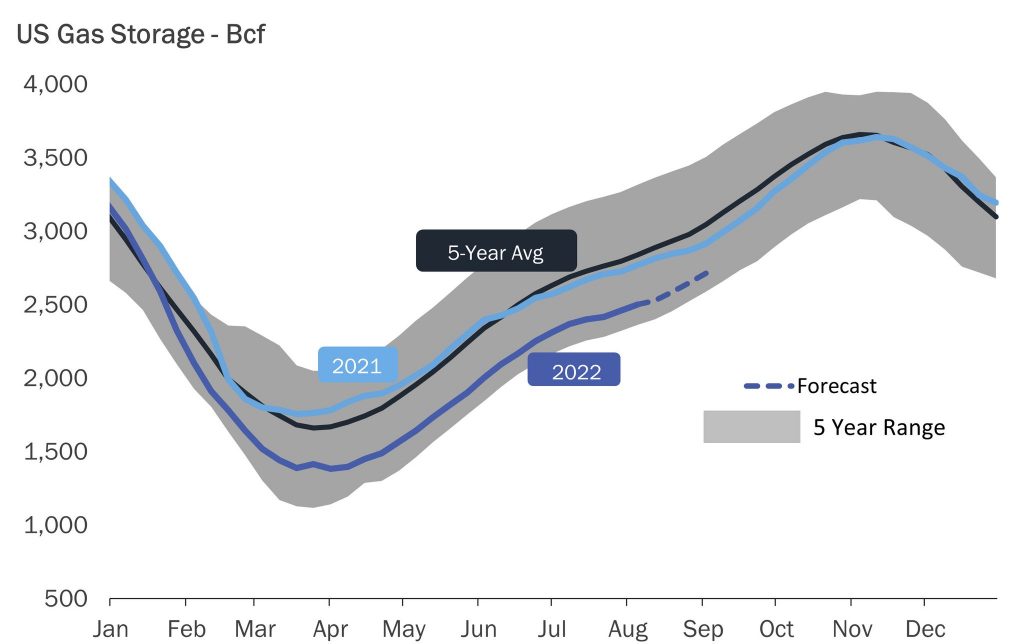

This morning (Thursday), the Energy Information Administration (EIA) will publish its weekly natural gas storage data report for the week ended August 12. Market estimates are for a storage build that is wide-ranging from as little as 19 Bcf to as much as 45 Bcf.

We are projecting a 26 Bcf storage build. The smallish build was the result of a significant dip in wind power generation over the course of the reflective storage week.

In terms of how NYMEX front-month gas futures might respond to the outcome of the storage data, a build of less than 21 Bcf will likely be construed as bullish and could send NYMEX futures up toward the $9.70s/MMBtu or higher.

Conversely, a storage injection of greater than 30 Bcf will probably be viewed as bearish, possibly triggering a sell-off back toward $9.00/MMBtu or perhaps lower.

Source: Gelber and Associates