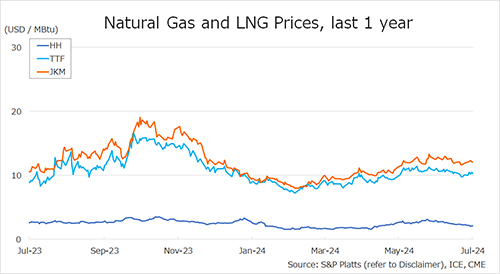

Gas prices moderated down in September, both in Europe and Asia

amidst continued demand destruction.

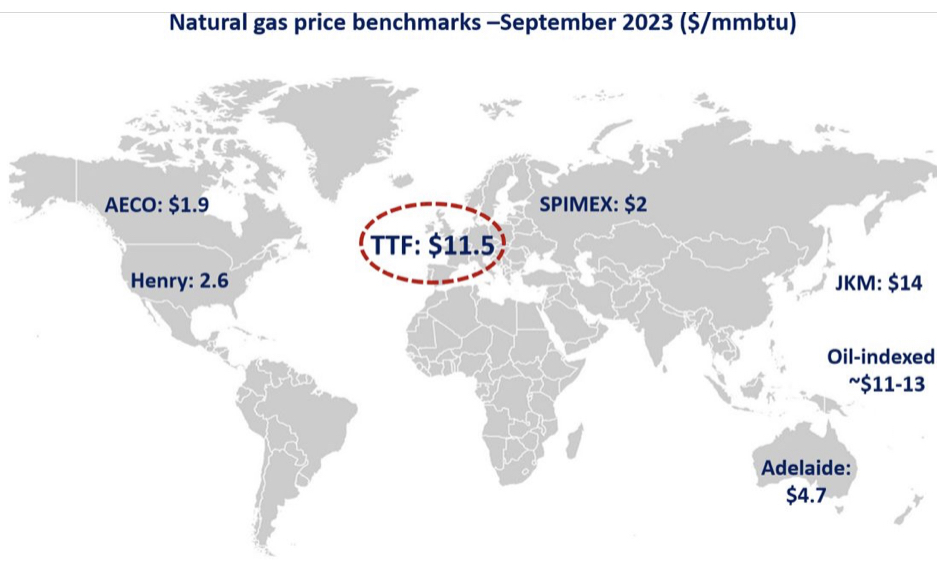

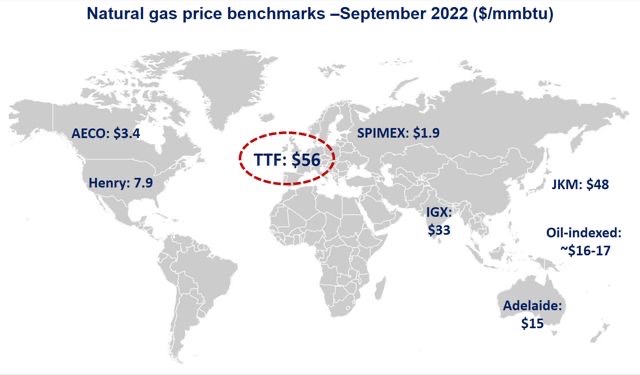

In Europe, TTF averaged at $56/mmbtu, its second highest monthly level although down by almost 20% compared to August. meanwhile NBP traded at a hefty discount of over $25/mmbtu compared to TTF due to greater access to LNG and lower injection needs.

European demand was down by around 15% yoy, largely driven by lower consumption in industry, with the most gas- and energy-intensive industries facing shut-ins.

The commissioning of the new Dutch LNG terminal in Eemshaven allows for a greater inflow of LNG which also weighed on prices.

Last but not least, European storage levels looks also healthier, close to 90% full and standing around 3% above their 5y average.

In Asia, JKM prices fell by 9% to $48/mmbtu, reflecting on the lower European prices and muted demand in the region. preliminary data indicates that China’s gas consumption was down by around 2% yoy in Sep.

In the US, Henry Hub prices dropped by 10% to an average of $8/mmbtu -its highest September price level since 2005.

US demand remains robust, up by over 5% yoy, largely driven by strong gas-fired generation. gas production hit several times above the 100 bcf/d mark.

What is your view? How will gas prices evolve in the New Gas Year? How do you the supply outlook for the upcoming heating season?

Source: Greg Molnar (LinkedIn)