An LNG player, believed to be the UAE’s Emirates National Oil Company (ENOC), has defaulted on its agreement to supply a cargo to Pakistan in February, state-owned firm Pakistan LNG Limited (PLL) confirmed over the weekend, and suggested the soaring spot LNG price in Asia is to blame.

Besides ENOC, Azerbaijan’s state-owned Socar Trading had also planned to back out of its agreed delivery next month, but was persuaded not to do so through diplomatic channels, Pakistan’s Dawn newspaper reported.

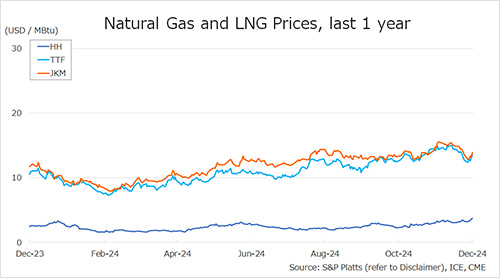

PLL confirmed the default at the weekend and issued a statement: “This bid default of the suppliers is associated with the recent supply shortages leading to high price volatility in the spot market coupled with extra buying in North Asia,” PLL said over the weekend.

PLL did not name the LNG player to have defaulted, only referring to the party as “the lowest bidder” as part of a supply tender it launched in November last year – seeking two spot cargoes for February 20201.

Bid documents show ENOC was the lowest bidder with a bid of 20.85% of Brent crude, equivalent to USD 10.22/MMBtu, for a single cargo to be delivered to Pakistan between 23-24 February, with Socar the other successful bidder with a bid of 23.43% of Brent.

Gas Matters Today contacted ENOC to comment, however the firm did not reply by the time of publication.

PPL suggested that its default experience is not an isolated incident, and suggested firms are reneging on contracts in a bid to make greater profits on spot LNG sales into Asia.

“There is news in the market about numerous global companies defaulting on their bids, or even contracts in some cases, given the supply shortages and extremely volatile prices. It is worth mentioning that the suppliers who have regretted to supply after bidding in the PLL tender include state-run entities and major international LNG traders,” PLL said in a statement.

The price of spot LNG has risen to a price around triple to what ENOC bid in PLL’s tender, with a perfect storm of cold weather in Asia, coupled with low LNG storage levels in the region and a tight shipping market, resulting in the spot price hitting a reported ~USD 32/MMBtu earlier this month. Meanwhile, the February dated Japan/Korea Marker (JKM) price is currently ~USD 18/MMBtu.

PLL said it is taking all measures available under law and PLL’s tender process, including forfeiture of bid bonds – of a reported USD 300,000 – against bidders who failed to supply cargoes as per their bids.

The default comes amid growing gas shortages in Pakistan, with the shortages leading to some downstream consumers searching for alternatives such as LPG and diesel fuel, according to reports.

Last month the main distribution companies began to inform non-exporting companies that they might stop receiving gas supplies as the state-run transmission firms faced deciding which customers would continue to receive natural gas. That situation might now be prolonged. Pakistan’s Cabinet Committee of Energy (CCoE) was to meet Monday to decide on whether the discontinuation of gas supplies to a large number of industries would be on a long-term basis, according to local media reports.

PLL attempted to ease concerns over the gas shortage.

“February being a low demand month, Pakistan has imported 7.75 cargoes in the month of February, on average, in the last four years. At this time, a total of 8 cargoes are secured,” PLL said at the weekend.

“PLL is working with the respective users to reconfirm demand at the current prices and is exploring alternatives if demand for an additional cargo in February is reconfirmed. PLL had already advertised unused capacity in its terminal for February 2021 and private sector may bring in additional LNG, which would be additional,” the state-owned LNG player added.

Meanwhile the CCoE is to review the overall gas situation due to the default and the shortages for various sectors, Dawn reported, adding that the committee might approve long-term policy guidelines to phase out electricity generation by the industrial sector on local gas, particularly for power generation through captive power plants.

This course has also been recommended by the Petroleum Division, the daily reported, saying that the government agency supports discontinuing the supply of natural gas as of 1 February to all industrial units that are using it primarily to generate electricity for their own consumption, with some exceptions.

Source: Gas Strategies

Follow on Twitter:

[tfws username=”GasStrategies” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]