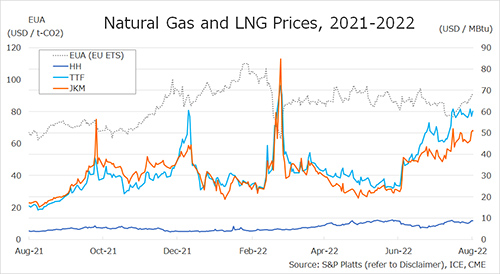

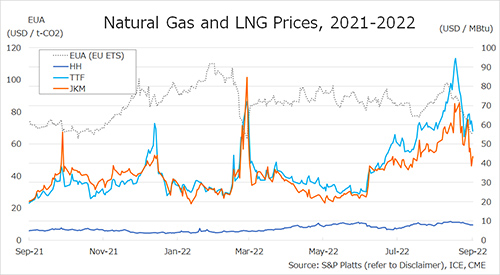

The Northeast Asian assessed spot LNG price JKM for the previous week (5-9 September) rose to USD 63/MBtu on 5 September from USD 49/MBtu the previous week due to buying back for the winter season and supply concerns in Europe.

The price then dropped to USD 46/MBtu on 6 September as market participants observed thin buying interest in China and other factors, but rose again on 7 September to USD 48/MBtu.

On 8 September, the price dropped to USD 39/MBtu due to lower spot demand and reports of talks in Europe on gas market measures.

METI reported on 7 September that LNG inventories for power generation as of 4 September totaled 2.65 million tonnes, up 190 thousand tonnes from the end of the same month last year and up 710 thousand tonnes from the five-year average.

The European gas price TTF rose from USD 53.7/MBtu the previous week to USD 65.3/MBtu and USD 65.6/MBtu on 5 and 6 September, respectively, due to the Nord Stream supply outage, lower wind power generation in the UK, stronger market conditions by traders and strong demand for natural gas for power in Spain.

TTF fell to USD 60.3/MBtu as traders searched for market direction and stayed quiet, but rose to USD 62.2/MBtu on 8 September due to supply uncertainty this winter.

On 9 September, TTF fell to USD 56.8/MBtu as the European Commission held an emergency ministerial meeting and reached some agreement on measures to combat gas and electricity price hikes.

The European Commission will discuss details in the coming days.

The U.S. gas price HH fell from USD 8.8/MBtu the previous week to USD 8.1/MBtu and USD 7.8/MBtu on 6 and 7 September, respectively, as traders assessed a receding domestic demand outlook and higher gas production.

However, it turned upward on 8 and 9 September to USD 7.9/MBtu and USD 8.0/MBtu, respectively. According to the EIA Natural Gas Storage Report released on 8 September, U.S. natural gas inventories on 2 September totaled, 2,694 Bcf, up 54 Bcf from the previous week, down 7.6% from the same period last year, and still lower than usual at 11.5% of the five-year average.

Updated 12 September 2022

Source: JOGMEC