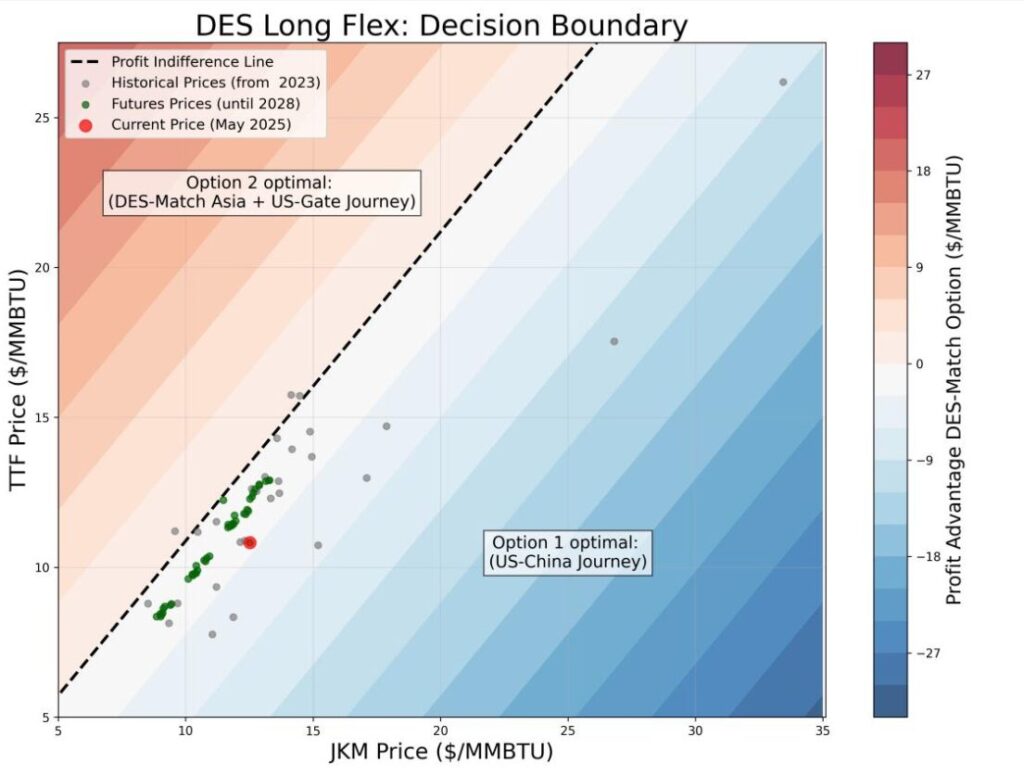

Calypso Commodities analysed how DES-Long flexibility in LNG portfolios creates significant value through comprehensive portfolio analysis rather than traditional isolated contract assessment. Key findings include: Operational realities (shipping costs, volume losses, vessel availability) fundamentally affect optionality value Stochastic valuation reveals and quantifies substantial volatility premium Portfolio-wide effects create significantly different valuations than traditional isolated contract analysis Source: Calypso Commodities