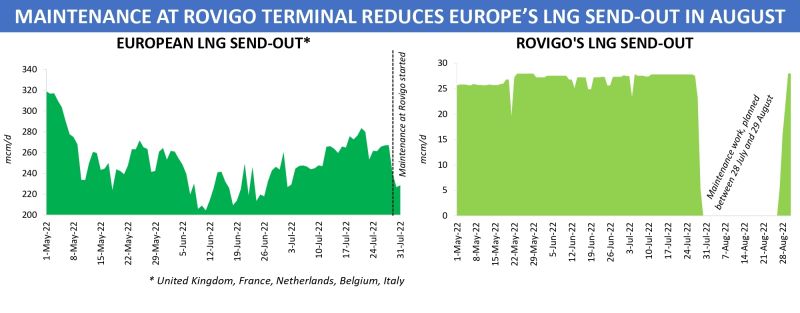

Unlike Europe’s gas pipeline imports, which have declined significantly over the past month, LNG continues to flow strongly into the region. In July 2022, aggregated deliveries of seaborne cargoes at the region’s regas terminals more than doubled compared to the same period a year ago. But what awaits the European gas market in terms of LNG intake in August?

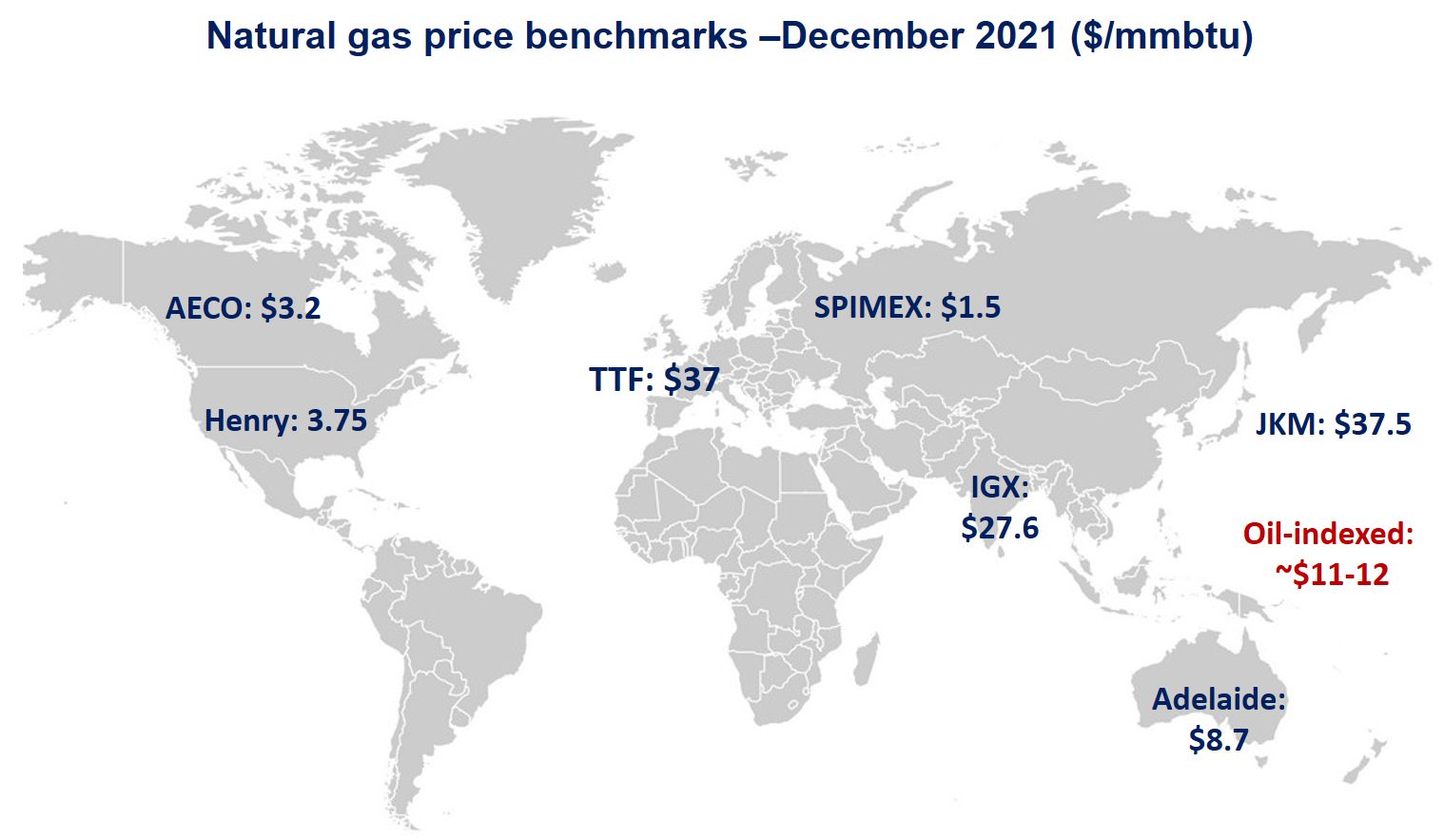

Given the current wide spread between TTF and JKM, there is no question for traders about what destination most spot LNG volumes should be sent to. In the context of emergency style preparation for the coming heating season, regional buyers’ demand for additional cargoes becomes only higher.

One of the few things that could prevent this month’s European LNG send-out from at least remaining at the July level, would be a kind of shutdown of some key import terminal for repair work. And this is exactly what is happening to the market in August, as the largest LNG regas facility in Italy has been taken offline until the end of this month.

Planned maintenance works on the Adriatic LNG has contributed to a 10pc decrease in total LNG send-out from the terminals based in Italy, UK, France, Netherlands and Belgium. Not surprise though, as flows from the Italian site into the transmission grid has amounted to more than 25 mcm/d throughout the summer 2022.

So what impact can the unavailability of regasified volumes from the Adriatic LNG have on PSV prompt contracts? In today’s conditions, making predictions about the future dynamics of prices, especially spot ones, becomes an increasingly thankless task. However, from a fundamental point of view, restricted LNG send-out should not undermine the country’s gas market balance as Italy is now entering the period of traditionally low business activity. In 2016-2021, the average daily gas consumption among Italian buyers was down 14pc (≈20 mcm/d) in August compared with July.

Source: Yakov Grabar (LinkedIn)