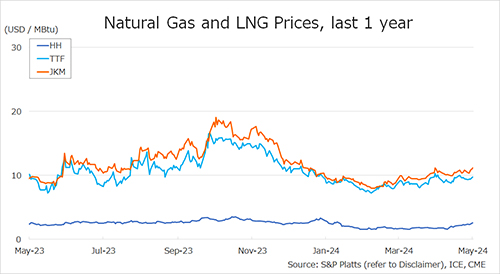

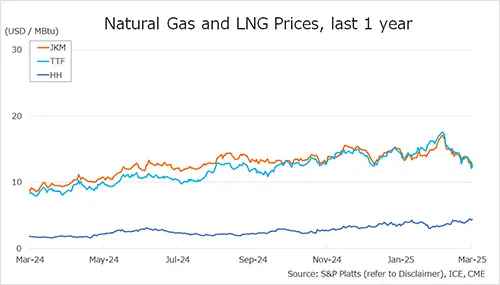

The Northeast Asian assessed spot LNG price JKM (April delivery) for last week (3 – 7 March) fell to low-USD 12s on 7 March from high-USD 13s the previous weekend (28 February). JKM was on a downward trend due to sluggish demand in Northeast Asia.

On 5 March, the price temporarily rose slightly from high-USD 12s to low-USD 13s due to increased purchasing interest from Southeast and South Asia, but fell back to low-USD 12s on 7 March. In the coming weeks, buying demand from Southeast Asia and South Asia is expected in preparation for the summer season.

METI announced on 5 March that Japan’s LNG inventories for power generation as of 2 March stood at 1.97 million tonnes, up 0.04 million tonnes from the previous week.

The European gas price TTF (April delivery) for last week (3 – 7 March) fell to USD 12.7/MBtu on 7 March from USD 13.5/MBtu the previous weekend (28 February).

TTF temporarily fell to high-USD 11s by 6 March due to warm weather, stable supplies from the Norwegian continental shelf, and information about the possibility of gas supplies via Ukraine resuming, but then rebounded due to increased geopolitical risks following the Russian military attack on Ukrainian gas production facilities, and returned to USD 12.7 on 7 March.

According to AGSI+, the EU-wide underground gas storage was 36.8% on 7 March, down from 38.5% at the end of the previous weekend, down 39.0% from the same period last year, and down 21.5% over the five-year average.

The U.S. gas price HH (April delivery) for last week (3 – 7 March) rose to USD 4.4/MBtu on 7 March from USD 3.8/MBtu the previous weekend (28 February). HH stabilized at a high of over USD 4 as the amount of storage decreased due to continued withdrawals from underground storage.

The EIA Weekly Natural Gas Storage Report released on 6 March showed U.S. natural gas inventories as of 28 February at 1,760 Bcf, down 80 Bcf from the previous week, down 24.9% from the same period last year, and 11.3% decrease over the five-year average.

Updated: March 10

Source: JOGMEC