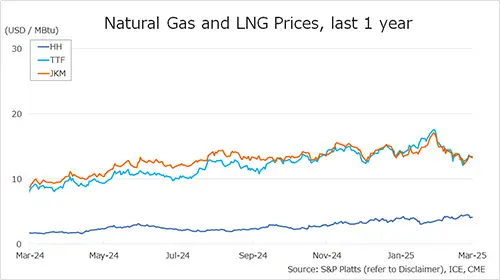

The Northeast Asian assessed spot LNG price JKM (April delivery) for last week (10 – 14 March) rose to low-USD 13s on 14 March from low-USD 12s the previous weekend (7 March).

JKM rose to mid-USD 13s on 11 March due to tensions in the war in Ukraine has been risen by the backdrop of the attack on gas production facilities in Ukraine on 7 March and President Trump’s threat of sanctions and additional tariffs against Russia over the peace talks.

JKM then turned around and fell to low-USD 13s on 14 March on the back of significant progress toward the peace talks conversely easing of geopolitical risks, as well as lower global gas prices and forecasts of lower demand in the shoulder season.

METI announced on 12 March that Japan’s LNG inventories for power generation as of 9 March stood at 1.79 million tonnes, down 0.19 million tonnes from the previous week.

The European gas price TTF (April delivery) for last week (10 – 14 March) rose to USD 13.5/MBtu on 14 March from USD 12.7/MBtu the previous weekend (7 March). The TTF rose to USD 13.7 on 11 March against the backdrop of forecasted colder temperatures across the Europe.

It then fell to USD 13.4 on 13 March as the prospect of lower geopolitical risks outweighed the impact of colder temperatures after significant progress was made in peace talks over the war in Ukraine. Then the price rose again to USD 13.5/MBtu on 14 March due to the impact of lower temperatures.

According to AGSI+, the EU-wide underground gas storage was 35.2% on 14 March, down from 36.8% at the end of the previous weekend, down 40.9% from the same period last year, and down 22.8% over the five-year average.

The U.S. gas price HH (April delivery) for last week (10 – 14 March) fell to USD 4.1/MBtu on 14 March from USD 4.4/MBtu the previous weekend (7 March). HH continued to decline throughout the week as the weather remained warmer than the seasonal norm for the same period.

The EIA Weekly Natural Gas Storage Report released on 13 March showed U.S. natural gas inventories as of 7 March at 1,698 Bcf, down 62 Bcf from the previous week, down 27.0% from the same period last year, and 11.9% decrease over the five-year average.

Updated: March 17

Source: JOGMEC